by WiseOcean | Jun 20, 2023 | Venture Investment

Read the briefing of this panel here in our Global Venturing TL-DR Newsletter.

Early-stage investors are often long-term partners of startups. Angel investors usually write first checks to entrepreneurs before venture capitalists can commit. Beyond funding, angels can be mentors/advisors for founders. They are usually high-net-worth individuals with industry experience and connections, who can open doors (make introductions) for startups. There are different kinds of angel groups. In this panel, angel investors from Taiwan, Singapore, Indonesia, and the US will share their experience in angel investing and how they evaluate, invest and help startups. (panel talking in English, Chinese briefing will be provided)

早期投資是投資者與公司之間的長期關係,天使投資者通常會在機構風險投資基金投資新創公司之前給出第一筆支票。 除了提供資金外,天使還可以充當新創的導師——例如,提供商業戰略指導。 天使通常是高淨值人士,他們也可能擁有可以幫助新創的寶貴人脈。 在這個會談中,來自台灣、東南亞和美國的天使投資人將分享天使基金或天使網絡的運作方式,以及他們如何與新創合作以幫助他們成長。台灣新創進入新的市場,等於在該市場從零開始,天使投資人可能是很有幫助的夥伴。(英文對談;中文重點翻譯)

話題

- Introduction to angels and angel networks / 天使投資人和天使網絡有哪些不同類型?

- How to find angel investors that are good partners for your startups? / 如何找到合適的天使投資人?

- How to raise funding from angel investors? / 如何向天使投資人募資?

- How do angel investors evaluate and invest in startups? / 天使投資人如何評估創業公司並進行投資?

- How might angel investors help and support entrepreneurs? / 天使投資人可能如何幫助創業團隊?

- What do you observe in the current angel investing climate? / 現在市場的天使投資與早期投資有何趨勢?

- What do angels expect to get from investing and supporting startups? / 天使投資人為何要投資與幫助創業團隊?

- What angel groups have created an average IRR > 25%? / 那些天使投資社群創造了平均 IRR > 25% 的成績?

- What are the secret sauce of successful angel networks? / 成功的天使投資社群有何秘訣?

- What are angel investors looking for in 2023? / 今年(2023) 天使投資人在找什麼投資標的?

- Introduction of Taiwan ITRI New Venture Association(台灣工研新創協會)、Central Texas Angel Network(美國)、Bali Investment Club(印度尼西亞)、Taiwan Global Angels。

Whether you are an entrepreneur or an angel investor, if you are interested in joining the conversation, and asking your questions to the panelists, including feedback on your startup, market insights, etc., sign up here. This is an invitation-only event. If you sign up, you can ask questions, and no matter whether you join or not, we’ll send you the meeting summary. 無論是創業者或天使投資人,都可以報名參加,跟這次會談者提問交流。只有報名取得會議邀請才能參加。如果你報名,無論是否參加,都可提問,我們會後將寄送會談重點摘要。

Speakers

Bryan Huang – Bryan is the Managing Partner of TaipeiLaw Attorney-at-Law and Co-founder of Taiwan Global Angels. He is a legal advisor for investment in China, Taiwan, and States with broad experience in all aspects of startup and venture capital, accounting, tax, and financial management. He is passionate about connecting Taiwan with the global community.

Joseph Liu – Joseph is a member of 3 angel networks, Central Texas Angel Network (CTAN), Tech Coast Angels (TCA), and Chemical Angel Network (CAN). He is a board director of CTAN. His investment portfolio is comprised of companies across Life Sciences, B2B Software, Hardware, and CPG industries. He has 5 exits and 30+ active companies in his portfolio. Joseph is working with Jessie on venture investment.

Michelle Kung – As the Chairman of the TINVA Singapore Chapter, she is currently assisting leading technology companies from Taiwan to enter into SEA markets through venture building, international funding, local market partnership, and governmental support. Michelle is an investor in tech start-ups in SEA and Europe. In addition to funding support, she continues engaging with the regional start-up ecosystem as a mentor/advisor/judge for start-ups and partners.

Tom Courly – Previously in management consulting, focussing on digital innovation and agile transformation, Tom now develops Indonesia’s Start-Up landscape, building the impact-driven venture giants of tomorrow with Bali Investment Club, angels, and founders. Tom is also a Strategic Advisor and Commissioner for many of BIC’s current and upcoming portfolio companies.

Jessie Chuang – Jessie is a startup mentor working with US and Taiwan teams, a partner at Network VC, a judge with Unicorn Battle and MassChallenge, and an angel investor with several US angel networks, and an emerging venture fund manager. Her previous experience includes 10+ years in semiconductor R&D and team management at UMC, and another 10+ years in corporate consulting on digital transformation working with executives.

About Foundersbecker

Foundersbacker is a unicorn factory in the circular economy industry. In other words, Founderbacker is an ecosystem builder focusing on the circular economy of food, cloth, and shelter; we call ourselves “Xiaomi in circular economy!”

About TaipeiLaw Attorney-at-Law

TaipeiLaw Attorney-at-Law stands with entrepreneurs and offers professional advice and effective strategies that do not backfire. We support clients on legal battlefields amid market competition. Our team includes attorneys and accountants fluent in Chinese, English and Japanese.

About TINVA

TINVA (Taiwan ITRI New Venture Association) is a Non-Profit Organization startup facilitator and venture builder that partners with various deep-tech stakeholders in order to provide startups with the resources, mentors, tools, and support needed in order to succeed. TINVA is associated with the top deep-tech research institute ITRI backed by the Taiwan government – the top source of deep-tech startups and innovations in Taiwan.

About Wise Ocean

Wise Ocean builds up a global network to connect proven startups or scaleups, industry leaders, corporate innovators, ecosystem partners, and investors for impact and profit-making. We are also building the Global League fellowship with global-minded investors for global collaboration.

About Founder Institute

The Founder Institute is the world’s most proven network to turn ideas into fundable startups, and startups into global businesses. Since 2009, our structured accelerator programs have helped over 7,000 entrepreneurs raise over $1.75BN in funding. Based in Silicon Valley and with chapters across 100 countries, our mission is to empower communities of talented and motivated people to build impactful technology companies worldwide.

Next Panel: How Deep Tech Startups Are Evaluated by VCs

by WiseOcean | Jun 19, 2023 | AI Digital Transformation, Major Trends

Key takeaways

- Startup funding is shifting from generative applications to infrastructure solutions to support enterprises build internal tools

- Language use cases dominate enterprise spending and VC investment

- Emerging AI startups with short-term tractions are everywhere, investors need to understand their defensibility and profitability

Generative AI’s fast emerging market

The global generative AI market is expected to reach $42.6 billion in 2023. This sector is the top trend observed from where recent VC funding goes.

The early stage of a tech stack is emerging in generative AI. Hundreds of new startups are rushing into the market to develop foundation models, AI-native apps, and infrastructure & tooling. Models like Stable Diffusion and ChatGPT are setting historical records for user growth, and several applications have reached $100 million of annualized revenue less than a year after launch.

What has now become the critical question: Where in this market will value accrue? Where do VCs bet on? Take a quick look at the sub-sectors with bigger funding: (> $500M in total)

Investment in infrastructure solutions stands out

AI development infrastructure:

- AI applications creation and productionization, e.g. AnyScale

- Run, tune, and deploy generative AI models on any hardware or in the cloud, e.g. OctoML

- Vector database for vendor search, to power semantic search, recommenders, and other applications that rely on relevant information retrieval., e.g. Pinecone

AI data labeling, curation, and model integration:

- Automated data labeling, integrated model training and analysis, and enhanced domain expert collaboration, e.g. Snorkel

- Generative AI architecture to integrate foundation models and all models, full stack for enterprise AI, e.g. Scale AI

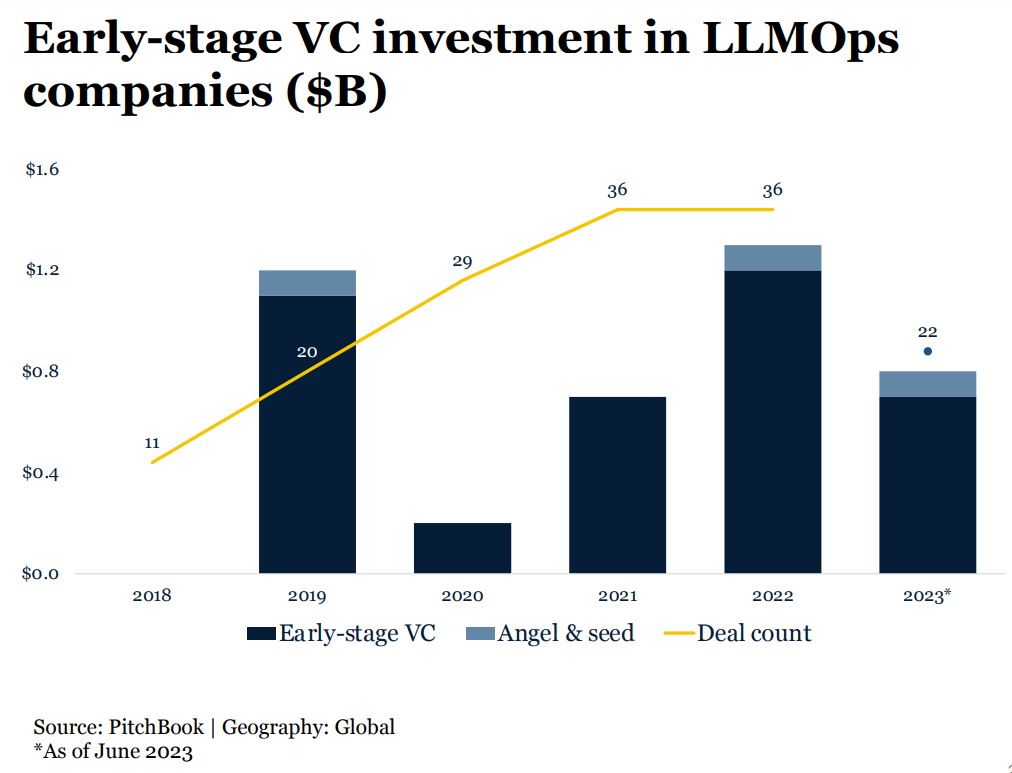

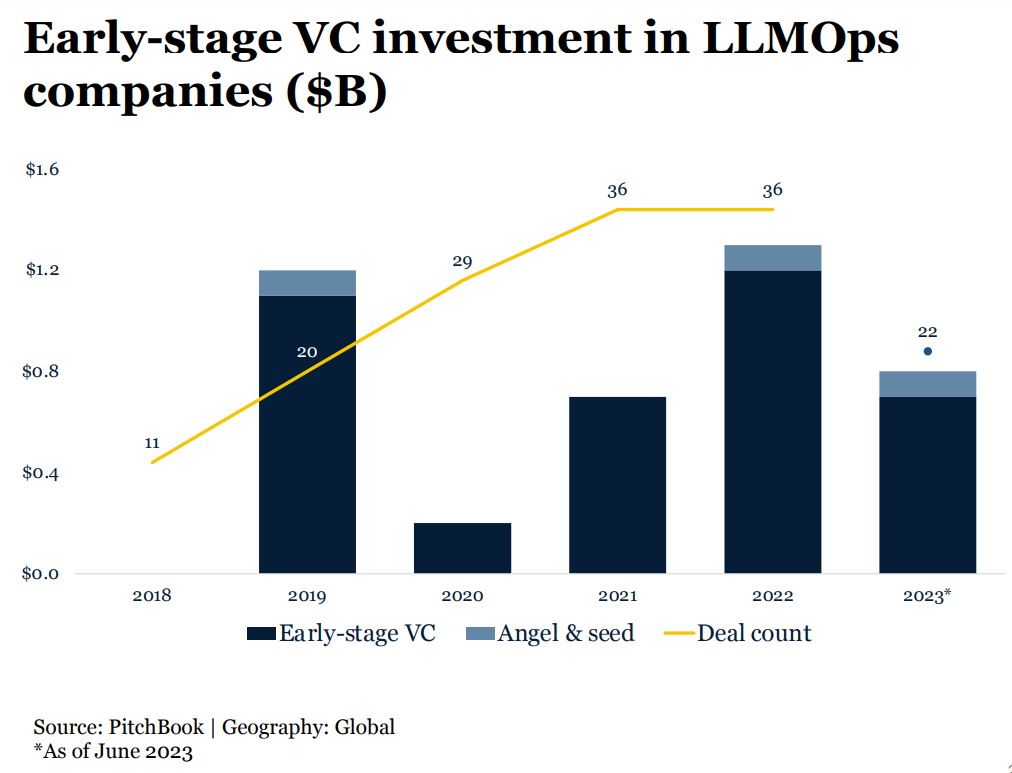

In the following chart from Pitchbook, the trend of early-stage VC investment in infrastructure solutions and data platforms going up is very strong against the backdrop of the overall financing climate downturn.

Breaking down the funding flowing into different capabilities in LLM infrastructure shows a lot of new startup categories are forming, including vector databases, prompt engineering, LLM model architecture, LLM orchestration, and LLM deployment, though winners are not yet clear.

Talking about AI infrastructure, everyone knows AI chips underlie all AI computing, but semiconductor is an area with a higher barrier of knowledge and resources for most VCs (read more about semiconductor AI opportunity here), investing in the software stack layer makes sense for them. It’s also a long-term bet, but without starting investing investors don’t get the learning opportunities toward a 10x return.

Language use cases are the new focus in AI applications

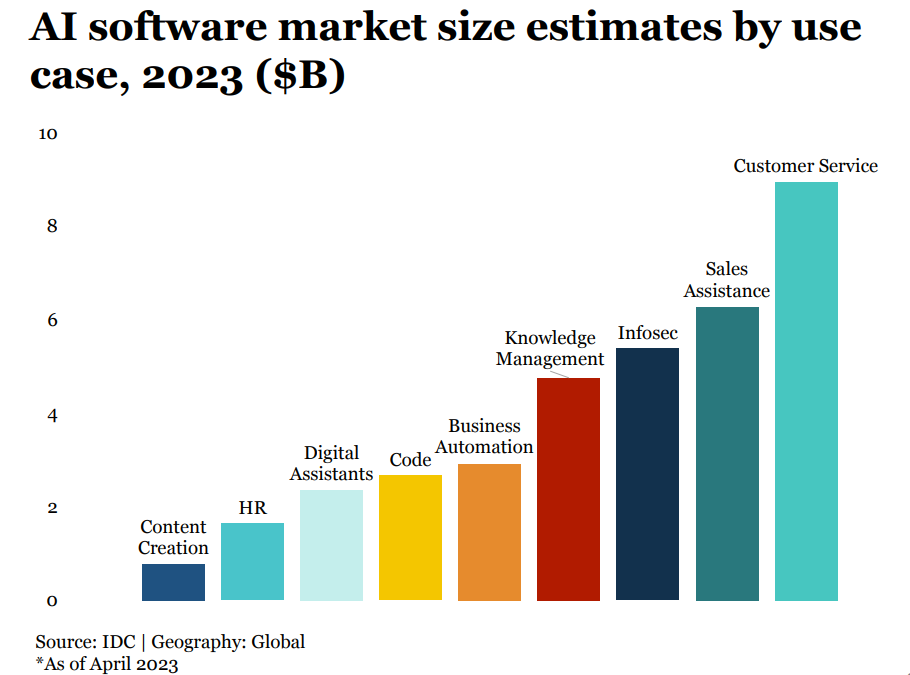

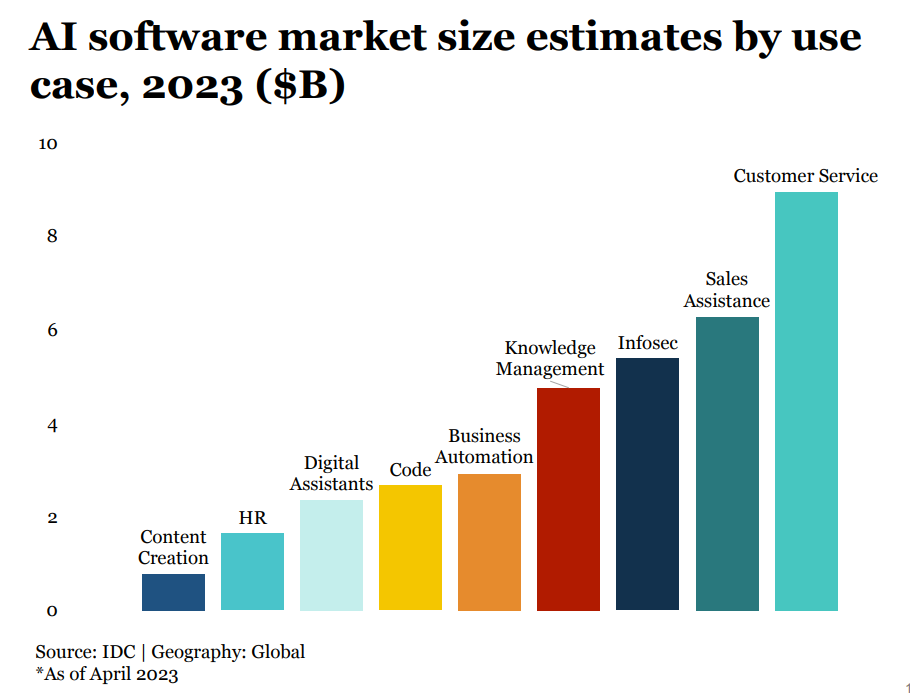

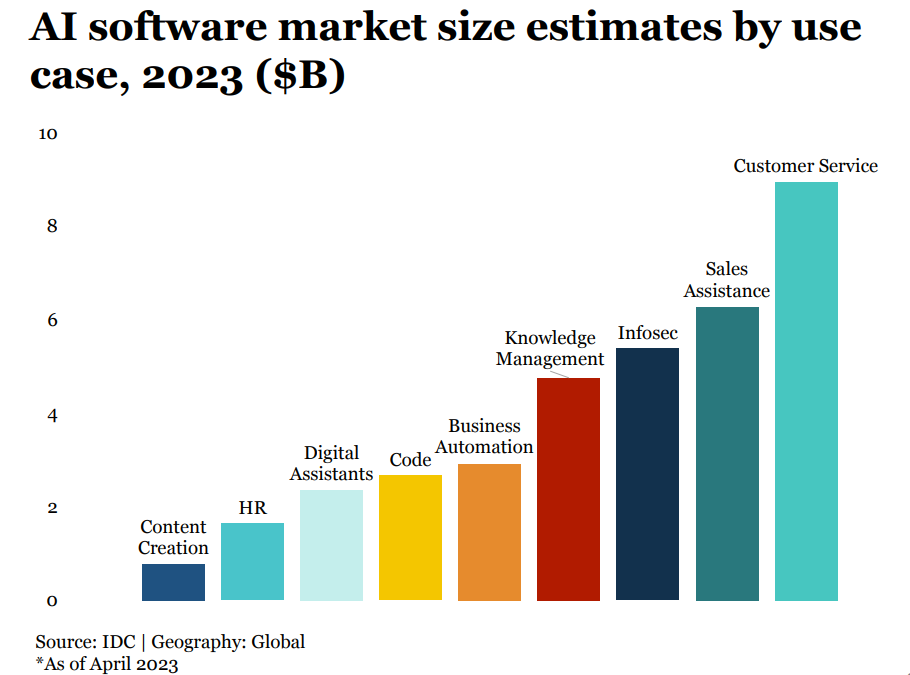

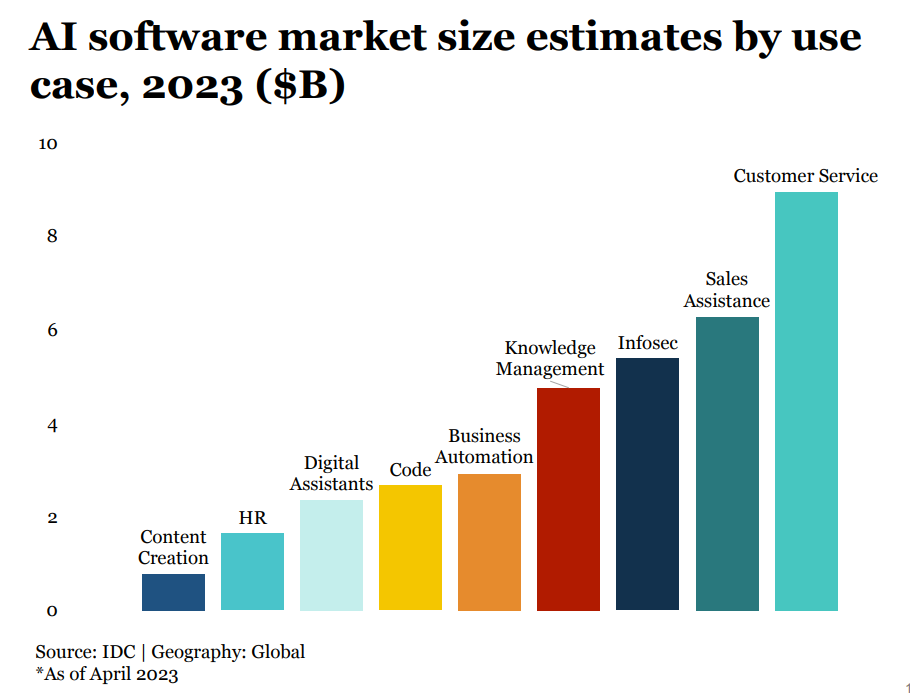

Language use cases dominate enterprise spending and VC investment. Applications in sub-sectors like marketing and sales assistance, customer service, infosec, and knowledge management get higher funding.

Visual media and content creation:

- Content creation suite for marketing or the like, e.g. Jasper (B2B or B2C content creation tool without proprietary models)

- Video creation tool, e.g. Synthesia (it makes video production possible for companies without actors, cameras or studios.)

Audio:

- Summarization for meetings, e.g. Fireflies.ai

Coding:

- AI coding assistants, e.g. Kodezi

Natural language interface:

- Chatbot and assistants (interface with customers), e.g. PolyAI, Cresta

- Search and knowledge discovery, e.g. Glean

Investors seeking long-term winners

In 2023 January, a16z wrote:

The growth of generative AI applications has been staggering, propelled by sheer novelty and a plethora of use cases. In fact, we’re aware of at least three product categories that have already exceeded $100 million of annualized revenue: image generation, copywriting, and code writing.

However, growth alone is not enough to build durable software companies. Critically, growth must be profitable — in the sense that users and customers generate profits (high gross margins) and stick around for a long time (high retention). In the absence of strong technical differentiation, B2B and B2C apps drive long-term customer value through network effects, holding onto data, or building increasingly complex workflows.

In generative AI, those assumptions don’t necessarily hold true, since the technology itself might change the market dynamics. (read more here)

All moats on deck

Getting OpenAI to focus on a particular corpus and answer questions from that corpus is no longer hard for people with a background in building software solutions. Open-source resources are available to startups as well as incumbents. Emerging AI startups with short-term tractions are everywhere, investors need to understand their defensibility and profitability in either vertical or horizontal positioning. Due diligence and analysis in technology, business, and other kinds of moats are important.

Investors can ask the startup what LLMs they’re using, whether and how they’re fine-tuning, and what their plans are for developing in-house models. Vertical LLMs might replace horizontal LLMs. Insights and data in verticals are a strong moat. Also, investors can ask how well/fast their solutions are adopted by their target audience. User experience and real impact metrics must be delivered, for example, productivity enhancements, and error rate reduction. Even a 1% improvement times a huge business value is worth pursuing.

AI transformation in many verticals is exciting, some verticals might see faster changes than others. But those investors who pursue only fast growth might miss long-term profitability. Behavior change, trust from users, organization change management (workflow change, value chain change…), regulations, physical limitations, relationship building, and other factors might create friction for AI adoption, but overcoming a barrier might become a moat that sticks for long. Last but not least, investors and startups need to watch the market landscape to prevent working on something that tech giants might come in later and take it away.

Reference:

Q2_2023_Emerging_Tech_Future_Report_Generative_AI, Pitchbook

by WiseOcean | Jun 18, 2023 | AI Chip, Major Trends

Key takeaways

VC investors have already shifted their focus to categories in which startups can carve out AI chip market share. In 2021 and 2022, AI/ML VC deal value in inferencing has become significantly larger than training-focused only, breaking a historical trend.

Both the PC and automotive AI chip markets are growing faster than the data center AI chip market at over 30% each, at this pace they will surpass data center’s market size by 2025.

Edge inferencing is likely to be dominated by existing vendors, all of which are investing heavily in supporting transformers and LLMs. So, what opportunities exist for new entrants? Automotive partnerships could be the hope; second, supplying IP or chiplets to one of the SoC vendors; and, creating customized chips for intelligent edge devices that can afford the cost.

PC and automotive AI chip markets

AI computing remains a major growth driver for the semiconductor industry, and at $43.6 billion in 2022, the market remains large enough to support large private companies. Also, the AI semiconductor market is divided into companies in China and those outside of China, because of the current political circumstance.

Nvidia is clearly the leader in the market for training chips, but that only makes up about 10% to 20% of the demand for AI chips. Inference chips interpret trained models and respond to user queries. This segment is much bigger, and quite fragmented, not even Nvidia has a lock on this market. Techspot estimates that the market for AI silicon will comprise about 15% for training, 45% for data center inference, and 40% for edge inference. The serviceable market for foundation model training will likely remain too small to support large companies, thereby relatively low acquisition offers are possible. Where is the opportunity?

Data center, automotive, and PC, these three sectors take 90% of the AI chip market if excluding the market of smartphones and smartwatches (to prevent data bias from Apple and Samsung), but the data center has 6 vendors taking 99% of market share, that market is saturated.

Both the PC and automotive AI semiconductor markets are growing faster than the data center AI semiconductor market at over 30% each, at this pace they will surpass data center’s market size by 2025.

Inferencing at the Edge

In the past 2 years, we saw a 69.0% decline in year-over-year VC funding for AI chip startups outside of China, VC investors have already shifted their focus to categories in which startups can carve out market share. In 2021 and 2022, AI/ML VC deal value in inferencing has become significantly larger than training-focused only, breaking a historical trend. Also, edge computing demands are driving more commercial partnerships for inference-focused chips than for cloud training chips.

Custom chips and startups can outperform the chip giant on specific inference tasks that will become crucial as large language models are rolled out from cloud data centers to customer environments – Inferencing at the Edge. The term ‘edge’ is referring to any device in the hands of an end-user (phones, PCs, cameras, robots, industrial systems, and cars). These chips are likely to be bundled into a System on a Chip (SoC) that executes all the functions of those devices.

What opportunities exist for new entrants?

Edge inferencing is likely to be dominated by existing vendors of traditional silicon, all of which are investing heavily in supporting transformers and LLMs. So, what opportunities exist for new entrants?

- Supply IP or chiplets to one of the SoC vendors. This approach has the advantage of relatively low capital requirements; let your customer handle payments to TSMC. There is a plethora of customers aiming to build SoCs.

- Find some new edge devices that could benefit from a tailored solution. Shift focus from phones and laptops to cameras, robots, drones, industrial systems, etc. But some of these devices are extremely cheap and thus cannot accommodate chips with high ASPs. A few years ago, many pitches for companies looking to do low-power AI on cameras and drones. Very few have survived. But, edge computing has become more prevalent in the trend of “smart everything”, and computing platforms also extend into wearables such as Mixed Reality headsets, technology advancements always push new possibilities.

- Automotive partnerships could be the hope, this market is still highly fragmented, but the opportunity is substantial. In Q2 2022, edge AI chip startup Hailo announced a partnership with leading automotive chipmaker Renesas for self-driving applications.

As the world is going through a major trend of electrification for decarbonization and automating optimization of energy usage and everything, edge AI chips with the right upstream and downstream partnerships are promising opportunities for investors and startups. The financial downturn may encourage M&A for some startups that align with the product needs of incumbents. Some historical examples are Annapurna Labs’ $370.0 million exit to Amazon and Habana Labs’ $1.7 billion exit to Intel.

References:

Inferring the future of AI chips, Pitchbook

邊緣 AI(Edge AI)的半導體創新機會

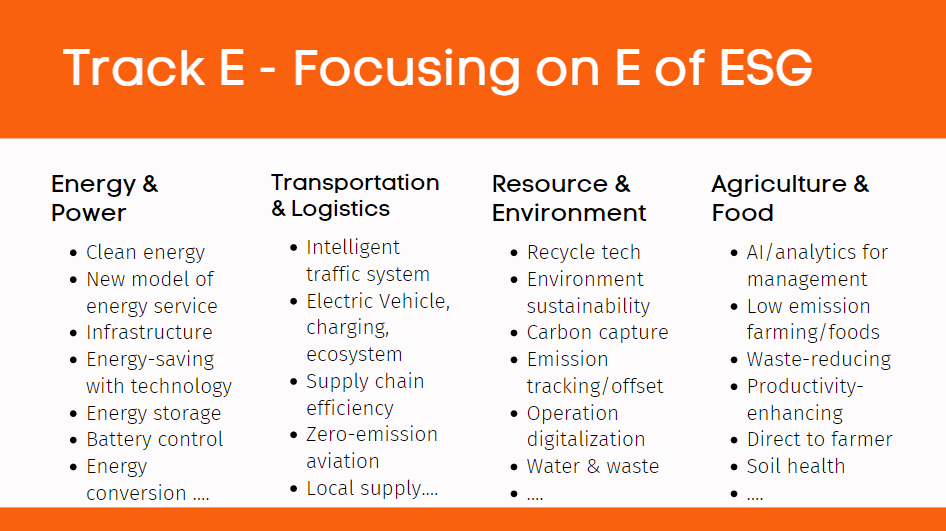

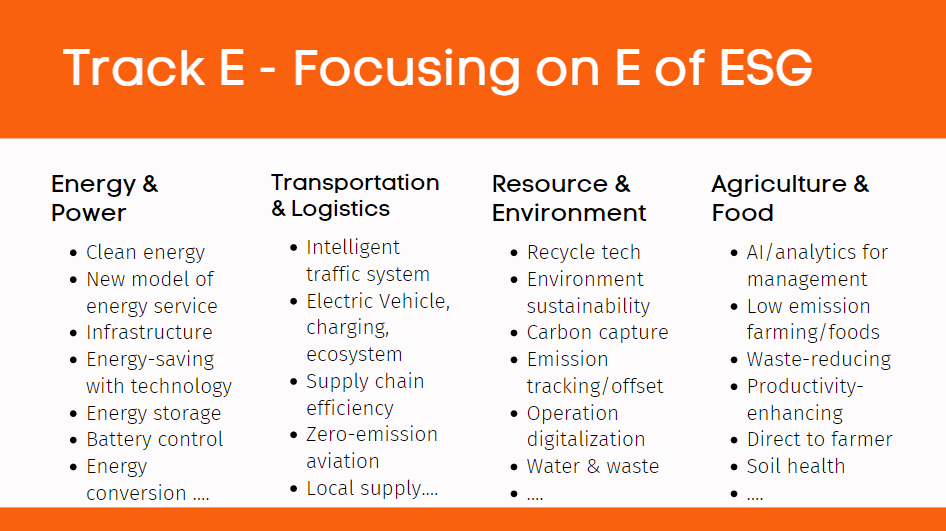

by WiseOcean | Sep 7, 2022 | Climate Tech

Managing Partner, Sustainability Ventures Group

Mr. Lawnin has been a serial entrepreneur for the past 30 years, has held senior executive positions at Fortune 500 companies leading global management consulting teams advising both domestic and international energy companies on strategic business transformation initiatives.

He currently sits on the Board of Directors for the Houston Angel Network, the most active angel group in the US, and co-leads their energy sub-committee. He is co-founder and board member of the Energy Blockchain Consortium, a nonprofit industry organization focused on building industry blockchain standards and use cases.

Managing Director, NoviDigiTech

Hani has more than three decades of experience (18 years in Shell) in operations, innovation, technology management, business consulting, and the full cycle of innovation from cradle to grave and from concept to commercialization in the energy industry with roles spanning technology, engineering, marketing, business, technology, and management.

He is now mentoring startups as an advisor who will help promote startups, and make introductions for them to strategic partners, key team members, or industry contacts in Energy and Healthcare domains.

Founder & Chief Strategist, Rho Impact

Noah is the Chief Strategist and Head of ESG Advisory Services at Rho Impact. With over a decade of ESG consulting experience, Noah has held multiple leadership roles including Senior Director for Summit Strategy Group’s ESG Consulting Services practice and serving as interim ESG Director for multiple public and private companies.

A recognized thought-leader in the ESG space, Noah has been influential at building ESG capacity at the industry level, having led the curriculum development for multiple industry-specific ESG certification programs. Noah holds an MBA in Sustainable Innovation and a BA in Community Development & Applied Economics (CDAE) from the University of Vermont. Noah also holds an MS in Mediation & Applied Conflict Studies from Champlain College.

Blogger, Consultant, Advisor on Climate Tech

Deanna is the creator of EtechMonkey, a climate tech blog, and ETM Advisor, a climate tech consulting practice. She is passionate about helping startups and others in the innovation ecosystem navigate energy transition.

Before starting ETM, she led the Energy Technology Banking division at Tudor, Pickering, Holt & Co., covering clients in areas such as energy software, industrial technology, environmental infrastructure, and alternative energy. She was responsible for deal origination and execution, performing industry and company research, and providing thought leadership in the energy technology space. She has advised dozens of companies on their capital and exit strategies, spoken at a variety of events and conferences, and written 100+ articles on the topics of energy transition and technology.

Deanna holds a BA in Statistics from Yale University and is a native of Houston, TX.

Operating Partner, SOSV

Strategic CEO thought partner + operator; demonstrated track record of revenue growth/value creation at global F500 and private companies (FB, Gannett, AOL, VideoEgg, Friendster). Scaled P&Ls from $0 to $100M+, built partnership pipelines, and launched multiple new products/services. Moves the needle from 0 to 1, starting @whiteboard and ending @revenue.

Independent public board director advising on strategic growth (new international markets/products), long-term value creation, ESG/workforce engagement, innovation, governance, compensation, and board recruitment/diversity. Consumer products/ digital media/ e-commerce/ energy/ entertainment/ insurance/ retail/ travel/ transportation.

WHAT I’VE DONE:

✓ MD @ $750m US multi-stage VC fund; 3 company valuations by 4x in 6 mo

✓ Dir @ £500m UK listed co; 3 new brands in 18 mos., stock +35%

✓ 6x public/private/non-prof Board Member – Chair, comp/gov/strat

✓ Fmr Obama Admin. appointee (@Commerce Dept.)

✓ Global exp: UK 4 yrs, Japan 2 yrs, ANZ 18 mo, deals in APAC/EU

✓ Mentor 4 black 1st time CEOs

Partner @ 8090industries & Portfolia G&S Fund

Fatimah Bello is focused on supporting global energy transition ventures and adjacent enablers; she collaborates with 8090 Industries Fund (as an Operating Partner), Portfolia Green & Sustainability Fund (as an Investment Partner), Climate Impact Capital (Venture Partner), and Rice Alliance Clean Energy Accelerator (Executive-in-Residence).

Before these, Fatimah spent over 20 years in corporate intrapreneurship, corporate and business development, product management, and leadership roles at Heliogen, SABIC (Aramco), and The Dow Chemical Company.

She holds an MBA from Rice University, a Master’s in Engineering Management from The University of Alberta, and a Bachelor’s in Chemical Engineering from The City College of New York.

by WiseOcean | Apr 18, 2022 | Startup Pitch

We will host our invitation-only online demo meeting with US investors on April 27, 10 AM, US Central Time.

First of all, thanks to these global-minded investors supporting our efforts to connect Asia’s top startups with US investors and strategic partners for going global.

We work with partners to screen and vet startups with proven technologies or business tractions with a highly selective process, and we help them find their core capabilities and positioning for going global, as well as prepare them for pitching to investors. Special thanks to Paul for mentoring these startups on pitching to investors!

For investors interested in joining this panel or getting select deal flows from Asia, please email us: Contact[at]WiseOcean[dot]Tech.

The startups are looking for strategic partners and investors in the US to scale up their impact in the global market. Here are select startups from Asia that will be showcasing their companies at this event. (in the order of beginning letters of names)

Cloud Rhema – New software architecture accelerates ML computing by 10-50X and reduces cost & emission by 50%

Cloud Rhema was founded in 2020 to address the pain points of machine learning adoption: cost, development barriers, and carbon emissions. Our AISpike architecture and platform accelerate AI computation by 10-50x, reduces costs and emissions by 50%, and support AI product development with automated, protected workflow steps and lifecycle management. From CPU, and GPU to Quantum computing stacks, it can be integrated with different hardware. We have been supporting computationally intensive industry use cases such as 3D modeling for smart cities and biotech product development, in the latter case, the computing time is reduced to one week from one year! Our solution can be scaled up to support global AI application developers with a SaaS business model.

Digit Spark – AI-empowered Martech solutions group grown 2.45x YOY for 4 years and scaling up now

Digit Spark was founded in 2017 to help corporations adapt to vastly changing consumer channels with our digital marketing technology (MarTech) which has an estimated global market size of $786.2 billion by 2026. We have used AI, combined with business and marketing domain knowledge, to help 1,200 enterprises grow their businesses. We have averaged 2.45x in revenue growth YOY for the past four years and have grown into a business group with four subsidiaries and six strategic partners. Our proven integrated solution enables up to 10-20x revenue growth for our customers and averages a 30% reduction in digital marketing costs. We expect to expand our current market size by 30x by scaling up our impact on companies in the Asia region and marketing their products/solutions to the global market.

Open AI Fab – Enabling healthcare providers using AI to improve quality of care and workflow efficiency

Open AI Fab, a winner of eight national competitions, was founded in 2019 to deal with the difficulty of implementing machine learning and AI in hospitals. This demand has a global market size of $7.3 billion USD before 2027. We have served over ten medical centers with our core capabilities in medical AI solution development integrating AI, software, hardware, and their ecosystems. 100% of our customers are very satisfied with our services from surgical assistance, emergency assistance to cardiology intervention, etc. We can co-develop with healthcare providers or medical product providers to transform their products or services into AI-enabled. We plan to take 5% of the domestic SaMD market by 2024 through a strategic partnership with Qualcomm and enter the US market through strategic team building and partnerships to scale up AI-as-a-Service for healthcare.

ZCON.ai – Smart Care Anywhere – Contactless Physiological Detection Using AI Face Recognition

Our technology enables contactless measurements of bio vitals with fast speed (within 30 sec.). The vital data include oxygen saturation, heart rate variability, blood pressure, heart rate, and stress indicator. The software can be embedded in all kinds of devices: smart mirrors, TV, PC, phone…, use cases can be extended to security gates, wearables monitoring the vitals of workers, and more. The pandemic has created a long-term strong demand for frequent monitoring of bio vitals with a contactless method. Within 3 years, we expect there will be $6 million USD revenue from our mobile App downloads (assume $3 USD for each), and $1 million USD revenue from a strategic partnership with a companion robot company in Asia. We plan to enter the US market through strategic team building and partnerships.

Asia startups, especially from Taiwan (an incubator island full of tech. innovations) have a diligent work ethic and high-quality tech. talents. Also, Asia is a market with strong growth momentum, reasonable valuation, and higher capital efficiency.

For investors interested in joining the panel or getting deal flows from Asia, please email us: Contact[at]WiseOcean[dot]Tech.