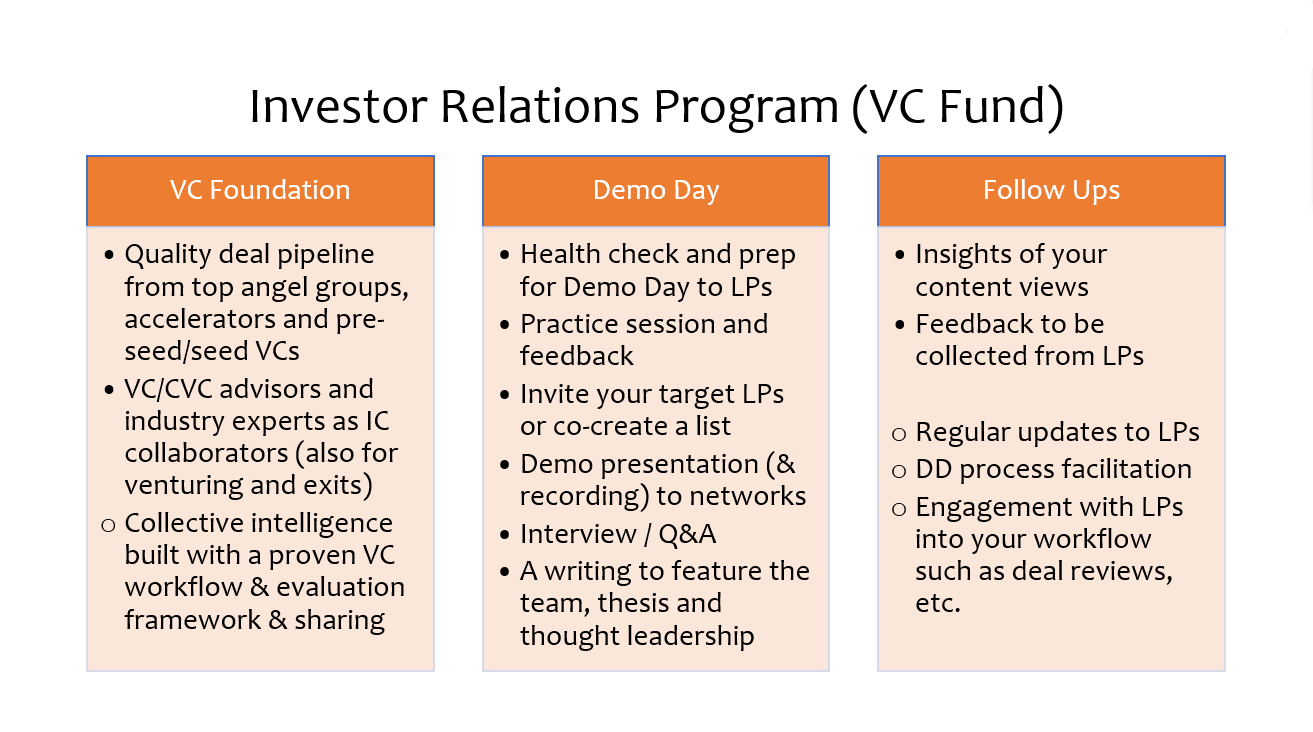

Our partnership with fund managers or family offices is based on our Global League knowledge community and expanding investor networks as well as outreach efforts to support investors. First of all, the core of our investor partnership is the collective intelligence building through network of intelligence and the platform.

Collective Intelligence

Collective intelligence for quality deal flows with Global League. Here are 8 steps. Plus, the step 0 — do our homework to study and identify quality sources.

- Curation of quality deals: recommendations from quality VCs, angels and industry advisors + active scouting from quality deal sources

- Documents shared by startups, current or potential investors, including DD reports done

- Review Committee: Form a small group of advisors, industry experts and professional investors, by invitation (we’ll reach out to relevant experts for each company as needed)

- Fellows: Get one sentence + one paragraph + pitch deck, and fellows sign up to interested deals

- Demo Day (startups with higher interests from the network): Presentation + Q&A meetings

- Evaluation and feedback by IC and fellows with a framework (reference)

- Sharing of all the above data collected + a deal memo to interested fellows only

- Follow-up meetings or regular updates for opt-in investors

Global League Platform

We are looking at stage pre-A/A and beyond, globally scalable deep technologies in emerging market opportunities.

Execution items can be selected flexibly according to demands.