Achieving deep emissions reductions in heavy industry (cement, steel, and chemicals production) can be challenging for several reasons. Carbon capture, utilization, and storage (CCUS) technologies might be among the cheapest abatement options – or the only option. For example, in the case of cement production, where two-thirds of emissions are from chemical reactions related to heating limestone, CCUS is currently the only scalable solution for reducing emissions. And in the iron and steel sector, production routes based on CCUS are currently the most advanced and least-cost low-carbon options, the same in the production of some important chemicals such as ammonia, which is widely used in fertilizers. More policies are supporting the carbon capture adoption now. (read more in IEA writing)

The cost of CCUS might be reduced as the maturity and infrastructures are improved, but that needs heavier investments and longer time horizons, and maybe not be suitable for most VCs or angel investors. Capturing CO2 is cheaper if compared with converting it from its capture solvent into a purified tank which could be up to 10x more energetically and financially costly. CO2 storage or transportation will increase operating costs or logistics burdens, the cost varies widely (data reference here). It’s better if we can utilize the CO2 immediately to create some valuable products which can be sold to create income to offset the cost or even make profits. It’s part of the so-called Carbon-to-Value (C2V) – a fast-emerging and evolving category. It could be the most VC-backable sector within the broader circular carbon economy.

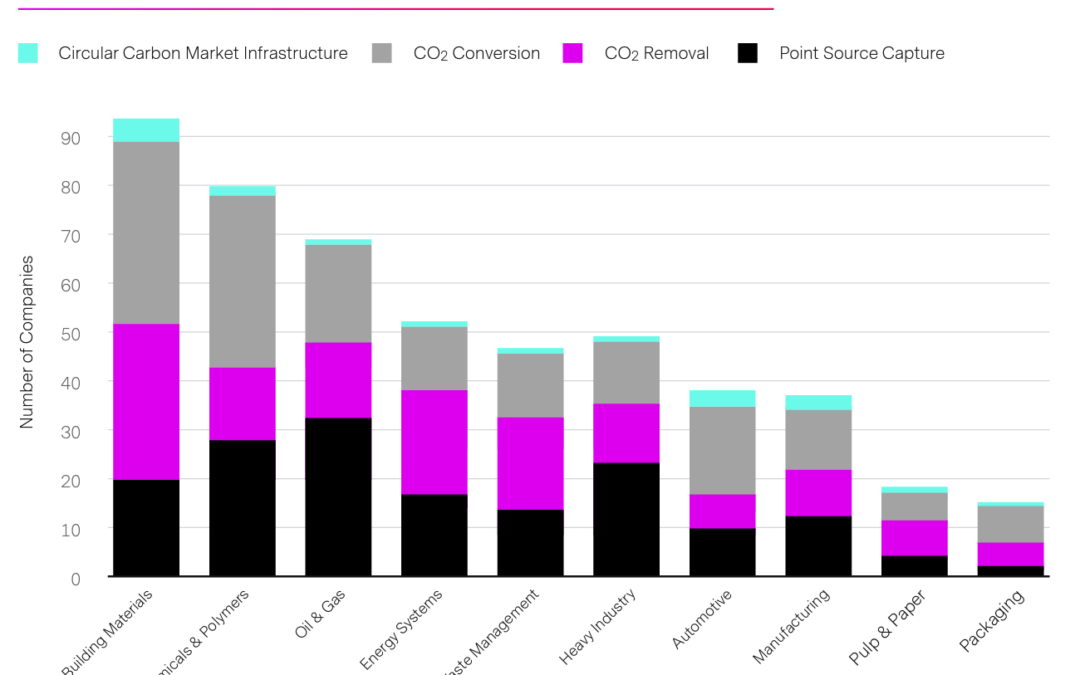

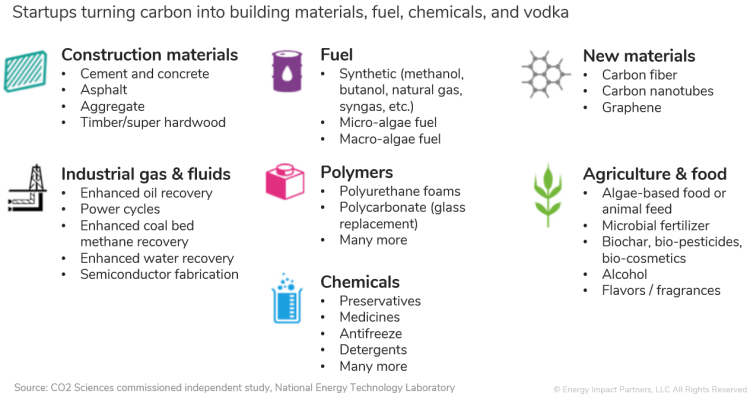

A significant amount of startups focus on carbon utilization applications, representing a very broad range of possible end products, from foods, and specialty chemicals to fuels and building materials, pictured below. There are 274 companies working on carbon conversion with some combined with other carbon solutions (removal, capture, etc) collected in Circular Carbon Network (an XPRIZE initiative) Circular Carbon Market Report of 2022.

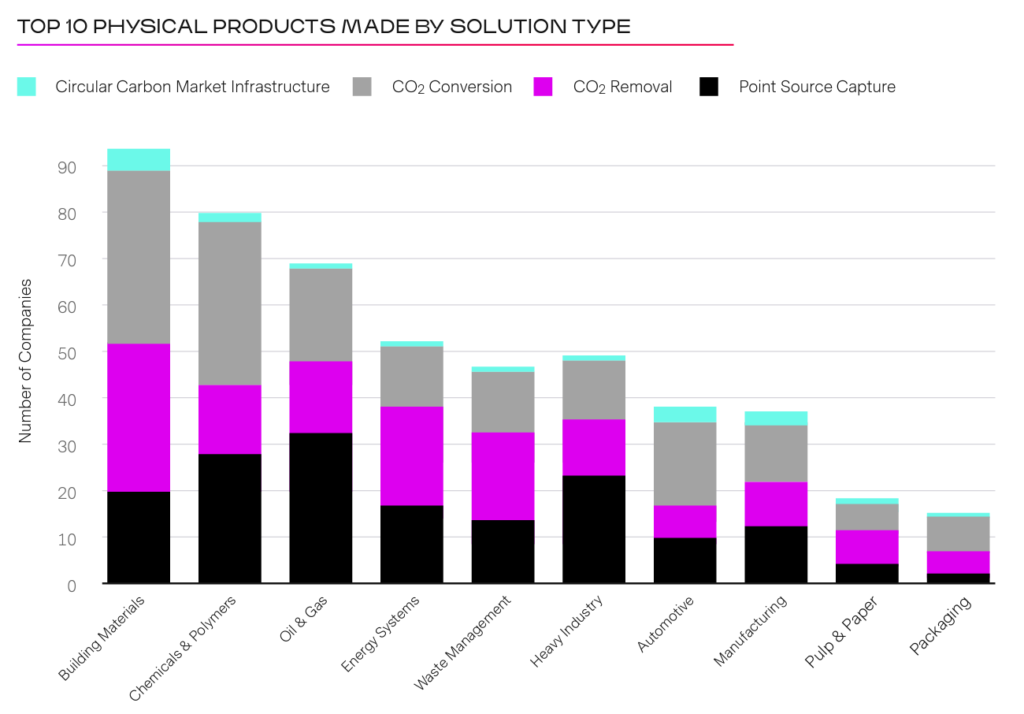

Circular Carbon Network has been tracking new companies in the carbon space, over half of all carbon tech companies (52%) within their carbon economy index report make a physical product, either in combination with offset sales and tax incentives or as the single revenue driver. Hard-to-decarbonize sectors such as building materials, industrial chemicals, and liquid fuels will likely have the largest addressable markets (estimated at $5.6 trillion collectively). Ideal C2V solutions can plug into those industries currently lacking a pathway to decarbonization to turn carbon and other by-products into useful and valuable products. Besides, the industrial gasses, consumer goods, and biochar categories also have more than doubled in size since 2021, suggesting larger investments or demand growth for these categories.

Credit: Circular Carbon Network

Major challenges are unit economics and “cross-the-chasm” adoption. Despite a few initial adopters, corporates will be reluctant to purchase carbon-negative products purely for climate reasons. C2V products still need to be comparable or cheaper than existing materials and even then, many legacy industrial, building, or transportation companies are extremely conservative and unwilling to adopt new technologies given the scale and risk of their businesses, and some industries are regulated. Digging into different contexts including driving policies in different industries and getting opinions from industry advisors are needed in making investment decisions.

For example, the EU has passed a regulation to recognize e-fuel made from captured carbon and green hydrogen from renewable energy as carbon neutral. Without a doubt, e-fuel has a significant opportunity in the aviation industry for Sustainable Aviation Fuel (SAF) since there is not much choice. And, the Inflation Reduction Act (IRA) has transformed the SAF landscape, with the inclusion or expansion of at least three significant tax credits. As a result, many “low carbon intensity” manufacturing pathways can become cost-competitive with conventional jet fuel. Subsidies and tax credits are important, IRA tax credits are transferrable and stackable, which creates significant funding for clean energy producers. (dig deeper here)

Figuring out the financing path early is essential. Among several types of funding sources supporting these carbon tech innovations — government and philanthropic grants, project equities and debts, and private investors, funding for equities raised from private investors (PE/VC) and angel investors is the largest category. Many climate tech investors have been getting more active this year even in the overall market downturn. But there’s a huge gap between early-stage venture capital checks and the $200m+ DOE loan program scale checks, CTVC’s post on the bridge to bankability addressed potential options.

Strategic business models are very important in terms of capital efficiency. It will be very hard for startups to sell equipment or services to a slow-moving, thin-margin incumbent, especially if they need to pay upfront dollars. Building a new full-stack company doesn’t always make sense, particularly when the cost of capital is high. In the so-called clean tech 1.0 era (2006 ~ 2011), some 90% of series A investments failed to return that initial investment, per a 2016 MIT study. Of those that did succeed, market returns were found to be lower than comparable investments in healthcare or software. We as investors can learn lessons from clean tech 1.0.

Corporates need climate tech to meet their climate commitments. To accelerate decarbonization in hard-to-abate sectors, the World Economic Forum, the Office of the US Special Presidential Envoy for Climate, and Boston Consulting Group created the First Movers Coalition with 83 blue chip members that have committed to buy more than $12 billion worth of net-zero products. On the other hand, large tech companies such as Microsoft, Shopify, Stripe, and Amazon have all made decarbonization investments – either through a dedicated climate fund and/or incorporating carbon removal options to customers. Climate Action 100+, the largest investor initiative on climate change, has signed 700 institutional investors managing a combined $68 trillion in assets to commit to leveraging their power and influence to ensure the world’s largest emitters take necessary action on climate change. United Airlines even formed an investor alliance and Sustainable Flight Fund to support startups developing SAF. More than 4,000 businesses around the world are already working with the Science Based Targets initiative (SBTi) for goal setting of climate commitments. Of course, global governments set up regulations are the sticks – corporations are under pressure.

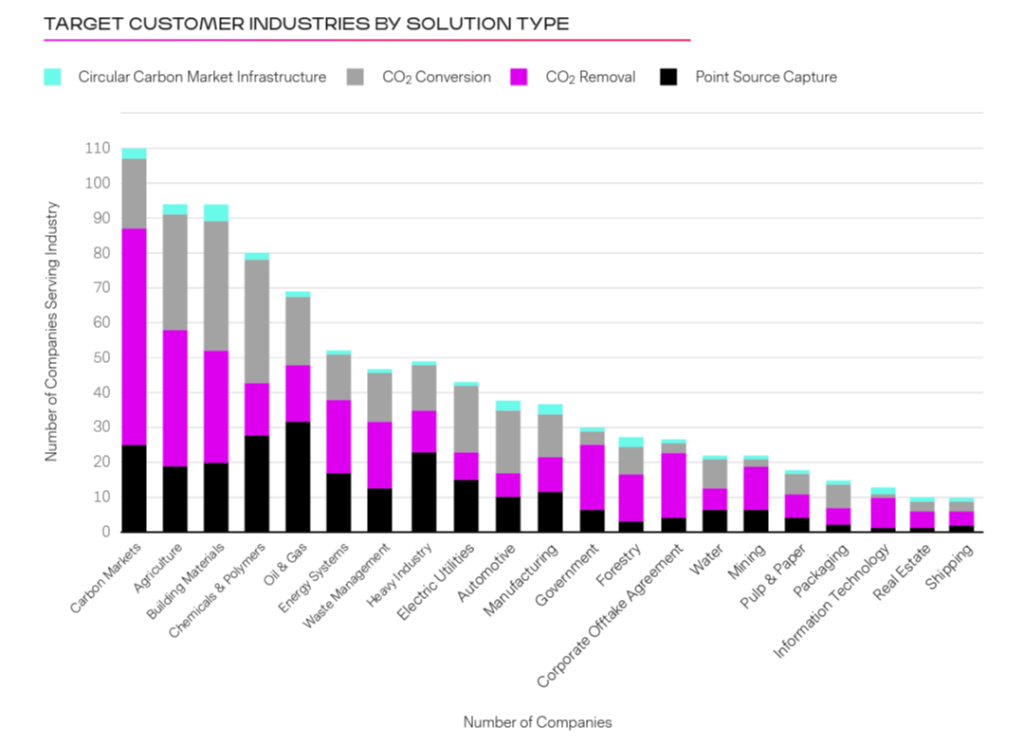

Carbon markets can help with carbon monetization to motivate the adoption. Circular Carbon Network surveyed companies about their target customer industry to further understand the potential customer bases of solution providers. In 2022 companies targeting Carbon Markets as a revenue stream made a huge jump to the top of the list as target customers for Circular Carbon startups, increasing 160% in responses. We’ll talk about the carbon market and software in the next post.

Credit: Circular Carbon Network

Join us for more discoveries and discussions on investment opportunities and risks in the emerging carbon economy.

Resource: Economic Feasibility for CO₂ Utilization Data Visualization Tool (from NREL)