AI share in the global VC funding keeps increasing, around $20B In February, more than a fifth of all venture funding in February went to AI companies, with $4.7 billion invested in the sector. That was up significantly from the $2.2 billion invested in AI companies in January 2024 and the $2.1 billion invested in February 2023, according to Crunchbase. GPU cloud, humanoid robots, and enterprise AI search got the bigger rounds that stand out.

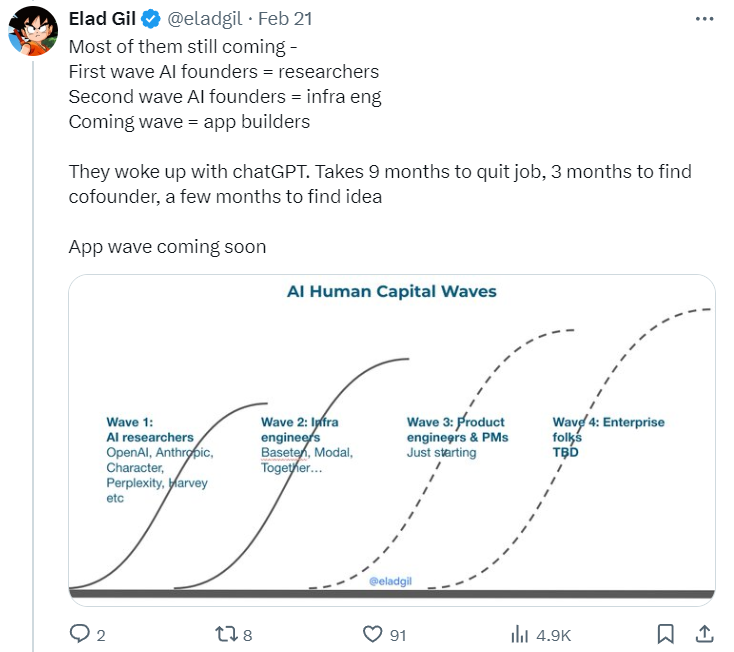

The deal value in AI startups ends Q4’24 with $22.3 billion across 1,665 deals. Powering these startups are AI-specific datacenters, whose specialized infrastructure and operations are designed to meet the rigors of AI workloads. Some startups in this space are challenging Microsoft, Google, and AWS (The Q4 2023 AI & ML report from Pitchbook). Also, Pitchbook reports that startups in the infrastructure SaaS market are ready to capitalize on the sea change that AI is bringing. The sector saw an uptick in VC funding in Q4 2023—reaching $2.2 billion compared to Q3’s $1.9 billion. Dharmesh Thakker of Battery Ventures predicted the software spend of around $600 billion will increase twofold to threefold over the next five to seven years as AI delivers productivity gains and leads to GDP growth. Let’s borrow the drawing depicted by Elad Gil – the wave of AI product and application building is coming, after the current infrastructure building wave. All are speculations.  The current AI wave is seen as a paradigm shift similar to mobile or the internet. Steve Sloane of Menlo Ventures gave a much longer review of tech waves and lessons (here). Because generative AI is riding on the readiness of software, digital transformation, data, and computing infrastructure already built previously, it has achieved an unprecedented adoption rate. But, that doesn’t equal the revenue generation rate. The most important model of AI is the business model. Menlo Ventures also surveyed more than 450 enterprise executives across the U.S. and Europe and summarized a report – The State of Generative AI in the Enterprise.

The current AI wave is seen as a paradigm shift similar to mobile or the internet. Steve Sloane of Menlo Ventures gave a much longer review of tech waves and lessons (here). Because generative AI is riding on the readiness of software, digital transformation, data, and computing infrastructure already built previously, it has achieved an unprecedented adoption rate. But, that doesn’t equal the revenue generation rate. The most important model of AI is the business model. Menlo Ventures also surveyed more than 450 enterprise executives across the U.S. and Europe and summarized a report – The State of Generative AI in the Enterprise.

Half of the enterprises we polled implemented some form of AI, whether into customer-facing products or for internal automation, prior to 2023. Enterprise investment in generative AI—which we estimate to be $2.5 billion this year—is surprisingly small compared to the enterprise budgets for traditional AI ($70 billion) and cloud software ($400 billion). Enterprises already used AI before. Enterprise execs cite “unproven return on investment” as the most significant barrier to the adoption of generative AI. The median enterprise we surveyed spends more on AI for product and engineering (4.7% of all enterprise tech spend) than on all other departments combined (3.5%). 3 predictions from the report are:

- Despite the hype, enterprise adoption of generative AI will be measured, like early cloud adoption (took years).

- The market will continue to favor incumbents who embed AI into existing products.

- Powerful context-aware, data-rich workflows will be the key to unlocking enterprise generative AI adoption.

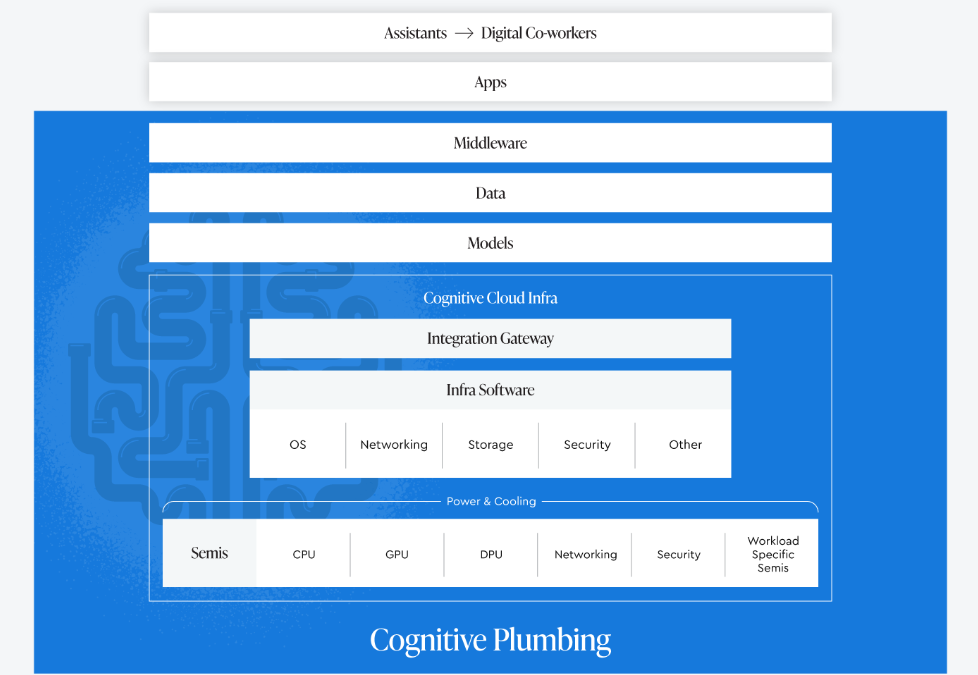

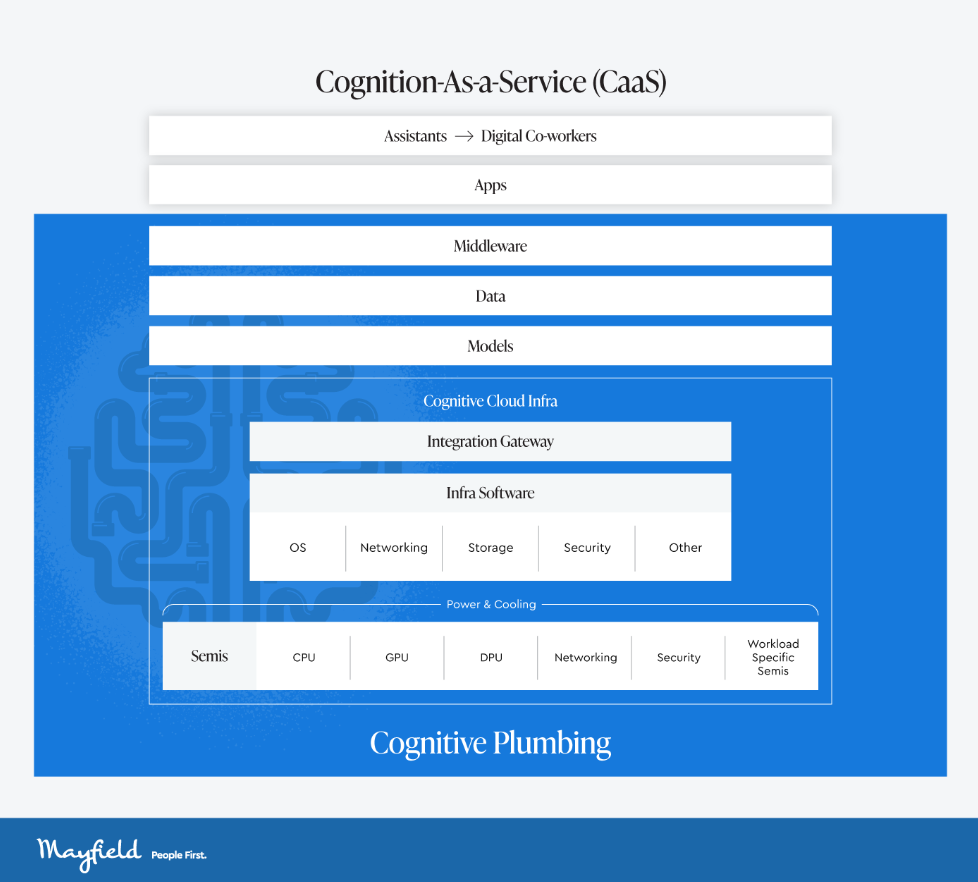

We agree with what Anthony Schiavo of Lux Research wrote in The AI revolution will look like a failure. It’s unlikely that the AI use cases generating hype right now will be the ones that drive a lot of revenue. However, LLMs’ ability to make interfacing with digital systems easy for nonexperts might have a meaningful impact on improving the adoption rate. These digital systems could be software, codes, and all physical systems, for example, factory floors, robots, oil field operational systems, defense systems, etc. And, it could enable collaboration between industry experts and those systems. Where will the most value accrue throughout the AI landscape?

Application companies might grow revenues quickly but often struggle with retention, product differentiation, and gross margins from lessons learned previously unless there are moats of adoption such as industry expertise and relationships. All the AI hype and hopes fuel the demands for AI infrastructure – software and hardware. Infrastructure providers are likely the biggest winners in this market so far and in the short term, capturing the majority of dollars flowing through the AI stack.

AI data centers are “picks-and-shovels” for all the above developments, desired explorations with generative AI, and even struggling efforts to find AI business models – all aren’t possible without AI servers. Big funding from VCs or tech titans going into the software infrastructure of generative AI stack in the past year only increased the devastated demand for AI servers and GPUs – hardware is more a bottleneck than software now. Nvidia and Supermicro are enjoying explosive revenue growth and have been breaking records for their stock market caps for quite some time (Supermicro stock goes up over 3X this year, 20X in 2 years, and Nvidia goes up over 2X this year, 4X in 2 years). But both depend on TSMC’s advanced node chip manufacturing and packaging technology. Only 2 months into 2024, TSMC’s revenue has grown around 10% despite the iPhone demand declining, TSMC market cap has grown 50% this year and became the 9th largest enterprise worldwide.

Taiwan has been manufacturing and shipping 90% of global computing servers even before the AI hype. Recently the Taiwan government needs to expand the capacity and area of air cargo operations to support the strong demand for global AI server shipments. TSMC has to keep building the most advanced fabs across Taiwan cities 24/7 (yes, the construction goes 24/7). There are tightly connected ecosystems for semiconductor and hardware manufacturing, that collaborate and respond to demands fast on the small island. Large companies invest in frontier innovations and build technology moats, their small key suppliers can grow fast riding on the wave with high capital efficiency and labor efficiency. These investment opportunities aren’t understood by or accessible to most US or global VCs. If you like to learn more, sign up here.

Thinking of eras — Cisco and HP in the 80’s, Apple and Microsoft in the 90’s, Amazon and Google in the early 2000s, and Facebook and Tesla in the 2010s. In the case of the dot-com bubble, Google and e-commerce allow people faster access to information and goods. Now generative AI is bringing us the next wave, what companies will become the representations of this era, and what opportunities are left for startups?

Anand at CB Insights notes: “The number of deals to AI startups backed by US big tech companies & their strategic venture arms jumped 50% year-over-year. This is the next big super trend, much like the internet and mobile phones, and big tech is committed to not just not missing it but to driving it. They are all in on genAI.” James Mawson of Global Corporate Venturing reminds us: Silicon Valley is the center of the AI world now – but for how long? Abu Dhabi has set up a new technology investment company, MGX, looking to invest up to $100bn in AI infrastructure (data centers and connectivity), semiconductors and core technology and applications such as AI models, software, data, life sciences, and robotics.

Related:

Abu Dhabi sets up technology investment company MGX amid AI push