The investor panel recording on the agri-food topic (Jan.19, 2024), and here is Transcription by Swell.ai.

Thanks to all the panelists for the great conversation and the Chat record is here.

Our special guest Thomas Mastrobuoni, CIO of Big Idea Ventures (BIV), shared sincerely about the agri-food tech ventures from his experience with BIV and Tyson Ventures. BIV has invested in more than 110 food tech startups. Before BIV, Thomas worked with Tyson Ventures for about 3 years, launching and running their corporate venture capital group. It was the first CVC group for Tyson with a $150 million mandate from the company to invest across both enabling technologies, but also disruptive technologies, which led to investments not only in things like rapid pathogen detection and direct-to-consumer platforms but in alternative proteins as well, both on the plant-based side and on the cultivated or cell-based side.

We call it the Generation Food Rural Partners Fund, or GFRP. This fund is very different than the new protein fund strategy. This fund works for solving problems in the supply chain for food and agriculture companies. So we will talk to the Nestle’s, we’ll talk to Unilever, all the way down to a small stakeholder farmer, here in the States and in Europe. And we’ve built basically a data lake of problems that these folks are trying to solve, whether it’s around single-use plastics, scaffolding for cultivated proteins, replacement for petroleum-based adhesives. We map the universe of problems as well as we can. And then we work back to a pool of university-developed research and IP. And the goal is to start around 20 to 40, depending on how big the fund gets, but 20 to 40 new companies based on baskets of university IP, so not one patent, but multiple patents, coupled with experienced management teams to build companies to solve some of these problems that these companies are trying to face, which are the reasons why none of them are going to hit their GHG reduction goals in time.This fund is also a licensed RBIC fund. RBIC stands for Rural Business Investment Company. It’s a license issued by the USDA, very similar to SBIC funds. It’s a license that allows banks to invest in our fund. Any other LP can invest in our fund. Typically banks cannot invest in private funds due to the Volcker rule, but SBIC licenses and RBIC licenses are exemptions to that. So we launched our fund with 10 farm credit banks.So if you’re a farmer in the US, you bank at farm credit, your mortgage is with them, your tractor leases are with them, etc. They have a mandate to drive economic growth and development in rural communities. And they do that with us by committing LP capital to our fund. And we spin up new companies, as I said, to solve these supply chain problems. And we put our new companies and the living wage jobs we create in rural communities to drive that economic growth and development. Our areas of focus are food, protein, and agriculture. We’re purposely broad.

Below is our writing about the context of the agri-food system.

The Agri-Food Industry can become net-positive

About a third of human-caused GHG emissions originate from the world’s agri-food systems (source), it accounts for 25% of global CO2 emissions (source), and 41% of global methane emissions (source). This scale has driven significant investments in decarbonization along the value chain. Declaration on Sustainable Agriculture, Resilient Food Systems, and Climate Actions was announced on 1 December at COP28 and was endorsed by 134 heads of state and government. Unlike some other hard-to-abate sectors, the food industry can play an important role in the net-zero transformation since it has the opportunity to become net-positive, by achieving net zero and acting as a carbon sink for other sectors.

On the other hand, agriculture is the sector most affected by climate change according to the UN Food and Agriculture Organization. Over the last 3 decades, agriculture losses accounted for an average of 23% of the total impact of disasters across all sectors. Climate change is accelerating land degradation and making it harder for food systems to adapt, posing significant threats to food producers. This can include both workers and working conditions impacted by extreme weather. Regarding agriculture, only five countries have benefited from climate change, while 21% of overall global agriculture productivity has been lost (source). Investing in climate adaptation and resilience for our agri-food system could be a massive opportunity.

Opportunities

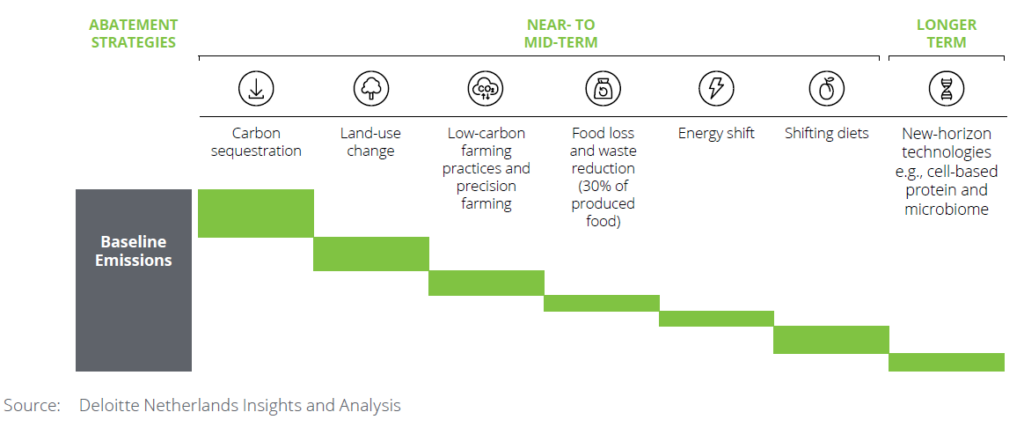

GHG emissions from food production could be reduced by 90% in the near- to medium-term (reference: Roadmap for achieving net-zero emissions in global food systems by 2050). In the report of Deloitte’s “Pathway to Decarbonization – Food”(2023), Deloitte created a chart to visualize levers for a net zero food sector as below.

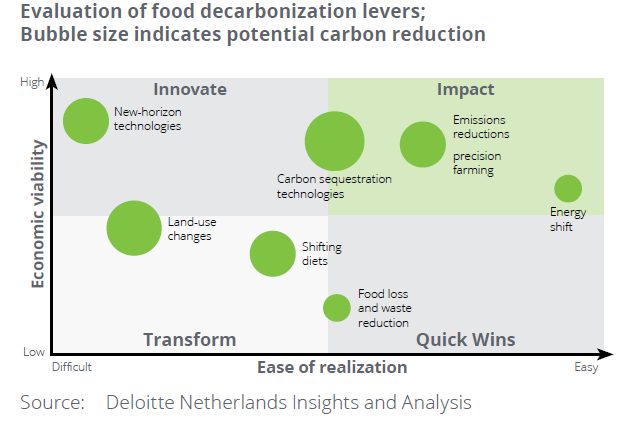

Implementing these decarbonization levers will require significant financial investment and change management across the food ecosystem. Except for food loss and waste reduction, there are no quick wins. From the Deloitte report, this chart depicts the economic viability and ease of realization of those levers, those levers falling in high economic viability and high ease of realization are more likely to make bigger impacts in the shorter term.

Emission reduction for farming or inputs can greatly reduce both CO2 and methane emissions. Rice and livestock are the main emitters of methane in agriculture. There are opportunities to drive on-farm decarbonization or reduce applications of inputs (fertilizers, pesticides, etc.) and capture business value. Decarbonizing those inputs matters too. And, new bio methods are emerging to reduce enteric emissions in livestock such as methane vaccines, etc.

Precision farming and digital transformation can make food production more sustainable. Digital management software, data analytics and AI, sensing technologies, robotics, electrified equipment, carbon monitoring, digital marketplaces, etc. can support data-driven decision-making in farming and demand forecasting, reduce labor needs, level up operational efficiency (faster response or automation, higher crop yield, better animal health), reduce chemical inputs, and water use, and reduce waste.

Switching to renewable energy sources to power food production and distribution can lower emissions. The food sector could also produce energy from waste using devices like bioreactors. Anaerobic digestion can turn organic matter into electricity, heat, or renewable natural gas or fuels.

Carbon sequestration can remove carbon from the atmosphere. For example, changing the way of treating soil can contribute greatly to emission reductions. Increasing the organic matter – and therefore the carbon stored – in soils can be done in a variety of ways, such as applying compost, biochar, or organic fertilizer. Some methods can make sure carbon stays in the soil. Agroforestry, which combines agriculture with the carbon storage capabilities of forests, is another promising option.

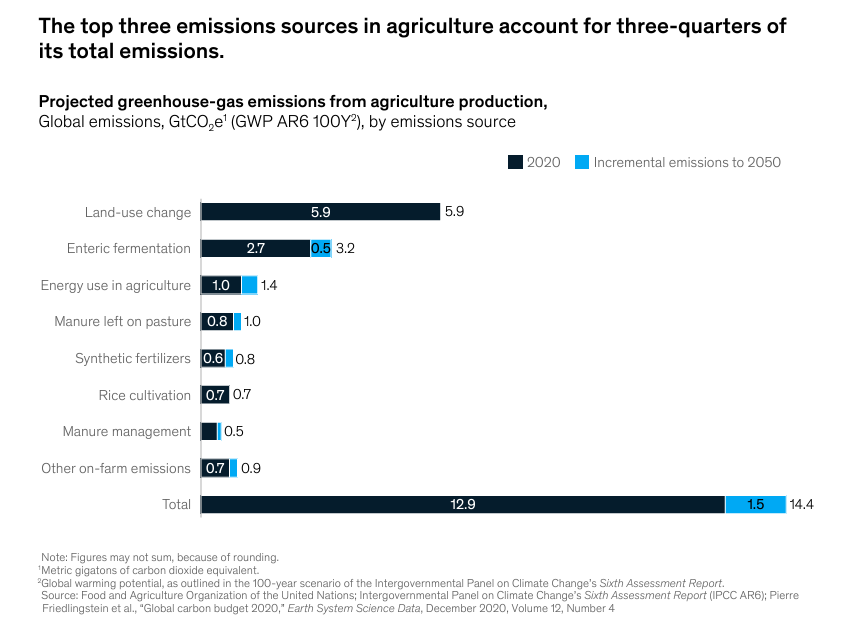

From McKinsey’s report: The agricultural transition: Building a sustainable future (June 2023): a wide variety of emissions sources are associated with agriculture; however, three major sources combined account for nearly 74 percent of the total, making them excellent targets for action – land use change, enteric fermentation, energy use in agriculture. (image below)

Agriculture alone is estimated to account for approximately 80 percent of global land-use change, which profoundly impacts carbon release and negatively affects biodiversity and ecosystems. Agricultural land covers half of all habitable land and is responsible for 70 percent of freshwater withdrawals. In addition, food systems are the primary driver of biodiversity loss around the world. Restoration and conservation are the most effective levers for abating land-use emissions, in addition to others including integrated farming systems such as Silvopasture, agroforestry and agrovoltaics. Carbon and nature markets today are supporting farmers in adopting nature-based solutions such as cover cropping and no-till farming, for which they can generate and sell carbon credits. The Inflation Reduction Act in the United States includes $5 billion specifically for climate-smart forestry and wildlife protections.

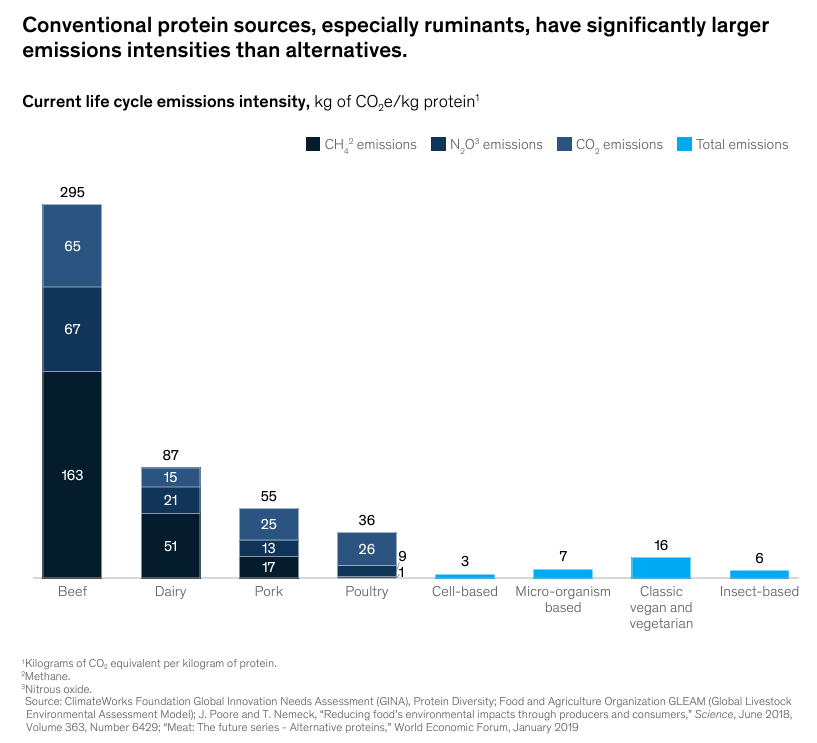

Shifting what we eat to alternative proteins is a powerful lever for at least 2 reasons. First, no methane emissions from livestock. These methane emissions increase atmospheric temperature approximately 80 times more than CO2 on a 20-year outlook, but methane has a shorter atmospheric lifetime than other GHGs, making it an effective target for reducing global temperatures quickly. Adopting alternative proteins, including classic plant-based products and precision-fermented and cellular products can avoid a substantial amount of emissions, and they have much smaller physical footprints (comparison as below, dietary shifts away from animal proteins could save nearly 640 million hectares of land, McKinsey pointed out) and consequently limit future land conversion while creating opportunities for sequestration.

Public funding for alternative proteins increased significantly, with governments worldwide more than doubling their investments in 2022 alone. As a result, all-time public support for the alternative protein ecosystem has likely surpassed $1 billion. In 2023 Upside Foods getting regulatory approval to sell their cultivated chicken in the US is a breakthrough. Policies can support consumer adoption of alternative proteins. This report from Good Food Institute tracks the investment, support, and regulation enacted across the globe. The shift to alternatives needs to be led by wealthier nations, they can afford such solutions. Developing nations could focus on enhancing animal productivity.

Food supply chain decarbonization includes smart packaging and supply chain efficiency measures that can reduce raw material consumption and the distance food needs to travel. Using bioplastics packaging or recycled packages can reduce emissions, Coca-Cola and 8 bottling partners created a fund focusing on this (source).

Novel Farming Systems, as the AgFunder-defined, include indoor crop farming systems such as vertical farms and greenhouses, insect ag, aquaculture, and algae production. There are very interesting big deals that happened in the Agriculture and Food sector in 2023.

From farm to fork, some innovations are happening closer to the fork side, such as digital food management, food waste reduction, traceability technologies, food safety solutions, 3D food printers, consumer engagement, etc.

Any innovations in the value chain need to make unit economics work. Most foods are commodities and farmers usually have thin margins, new offerings can’t transfer costs to the customers or downstream partners. And, startups can not play heavy Capex games, and might need to partner with big companies with a lot of cash, could offer offtake agreements or even operational agreements where they’re going to run the factory.

CTVC reported: that in 2023, the total funding in climate tech is $32B, a 30% drop YOY, while CAGR remains high since 2020 at 23%. Transportation and Energy investment declined but remained on top. Food & Land Use fell dramatically, down -55%, and was replaced by Industry in the big three. But, according to Pitchbook’s reporting, AgTech is the only sector with a median valuation held up +10% YOY, even better than the AI/ML sector. Is this a good time for investors to participate in the long-term trend? What are the solid trends and opportunities in this downturn stress test? What startups are moving the needle for the industry forward?

This Friday (Jan. 19, 2024), we’ve invited Tom Mastrobuoni, the Chief Investment Officer at Big Idea Ventures (BIV) to join our chat. Big Idea Ventures, with offices in New York, Paris, and Singapore, is the world’s most active investor in FoodTech and AgTech and has invested in 110 companies across 25 countries. The company has contributed to the development of the growing alternative protein industry since its inception. BIV is backed by a network of strategic partners including AAK, Avril, Bühler, Givaudan, Temasek Holdings, and Tyson Ventures, and is partnering with governments around the world working on food security and new food ecosystems. Take a look at their 2024 outlook: The Way Forward for Agri-FoodTech in 2024.

To join our chat on the ClimateTech Investor Panel, sign up here if you’ve not done so. Introducing yourself is welcome.

Note: Our panels/meetings aren’t for startups to pitch, but startups are welcome to share industry insights, and investors are welcome to introduce outstanding startups or funds. The goal is to discover trends and great startups or funds.

Note: To share your opinions by email, use Partner@WiseOcean.Tech, we’ll gather shared insights or news in Global League newsletters to our network. Our previous newsletters can be read here on LinkedIn. Subscribe to Newsletters to receive them in your email box.