Happy New Year, have a successful year of 2024 ahead! Start with a big picture for 2024.

Biggest Trends Behind Biggest Deals in 2023

Two biggest trends – generative AI and climate tech — dominated the 10 biggest CVC deals in 2023 (from Global Corporate Venturing), the implications of these deals are in parentheses.

- OpenAI, backed by Microsoft (AI is creating a new era)

- GTA Semiconductor, China, backed by domestic investors (China chipmakers have big ambitions, although lagging far behind globally)

- H2 Green Steels, backed by Hitachi Energy and Schaeffler (Big industrial processes are the next big growth area in cleantech)

- Leapmotor, China, backed by Stellantis (China continues to create big EV startups)

- Inflection AI, backed by Microsoft, Reid Hoffman, Bill Gates, Eric Schmidt, and Nvidia (Personal AI is going to be the most transformational tool of our lifetimes, that’s their bet)

- Anthropic, backed by Amazon (Big tech companies are ready to make huge commitments to stake a position in the AI race)

- Northvolt, backed by Volkswagen (securing batteries is crucial for automakers, other battery developers pulled in big money from carmakers – Verkor with Renault, China’s Libode New Material with GAC, Our Next Energy with BMW)

- EnergyRe, backed by Novo Holdings (diversified investors have been attracted to climate tech, and energy transformation will speed up)

- Redwood Materials, backed by Caterpillar Venture Capital and Microsoft’s Climate Innovation Fund (battery material recycling in the US is big)

- Stack AV, backed by Softbank (betting big in the autonomous trucking startup risen from the ashes of Argo AI, Softbank’s still at the table)

Global ClimateTech Funding Held Up Well in 2023

Quoted from Crunchbase: “While 2023 has been a down year for startup investment in most industries, cleantech and sustainability-focused categories have held up comparatively well. Per Crunchbase data, global investors have poured approximately $13.9 billion this year into companies working on everything from battery recycling to water-conserving crops. That puts 2023 on track to come in roughly even with last year. The busiest cleantech investors were even more active in 2023, there is no sign they’ll pull back in 2024.”

Battery startups have the biggest investments, and companies to watch have an overlap with the previous top 10 CVC deals. Carbon removal and climate software have steady strong interests as well. From Pitchbook’s Q3 2023 Clean Energy Report, the grid infrastructure segment received the highest VC funding in Q3 2023, with 41.5% of the total deal value for the quarter. The biggest opportunity for energy transition lies in the biggest challenge – the infrastructure. We cover the new model of the Virtual Power Plant in this panel with Thomas and Bob.

Previously China led the world in energy transition investments, Europe as a whole is also ahead of the US, and now the US is catching up – “the IRA will pour around $1.2T into this space in 10 years, it’s not a cap, it’s a projection!” (Juan shared)

A big difference between the cleantech 1.0 era and now is that the capital stack for climate tech has been developed rapidly and much more mature in the past 5-7 years. The briefing for our panel with Paul and Karen on “ClimateTech Investor Panel – Capitalization and Financing” is a must-read. There is a massive flood of public funding or loans into the climate space, and investors with deep pockets for growth and physical assets are starting to raise and deploy investment vehicles earmarked for climate (Paul elaborated with examples). Furthermore, climate tech companies have gained a new exit path – private equity is emerging as a new opportunity for liquidity outside of traditional strategic acquirers – quoted from Kevin Stevens, Energize Capital. He noted: “This trend is set to continue in 2024. The one nuance is a newly added emphasis on profitability alongside growth as servicing debt costs remain high.”

Defence Tech is the Sector Winner of all in 2023

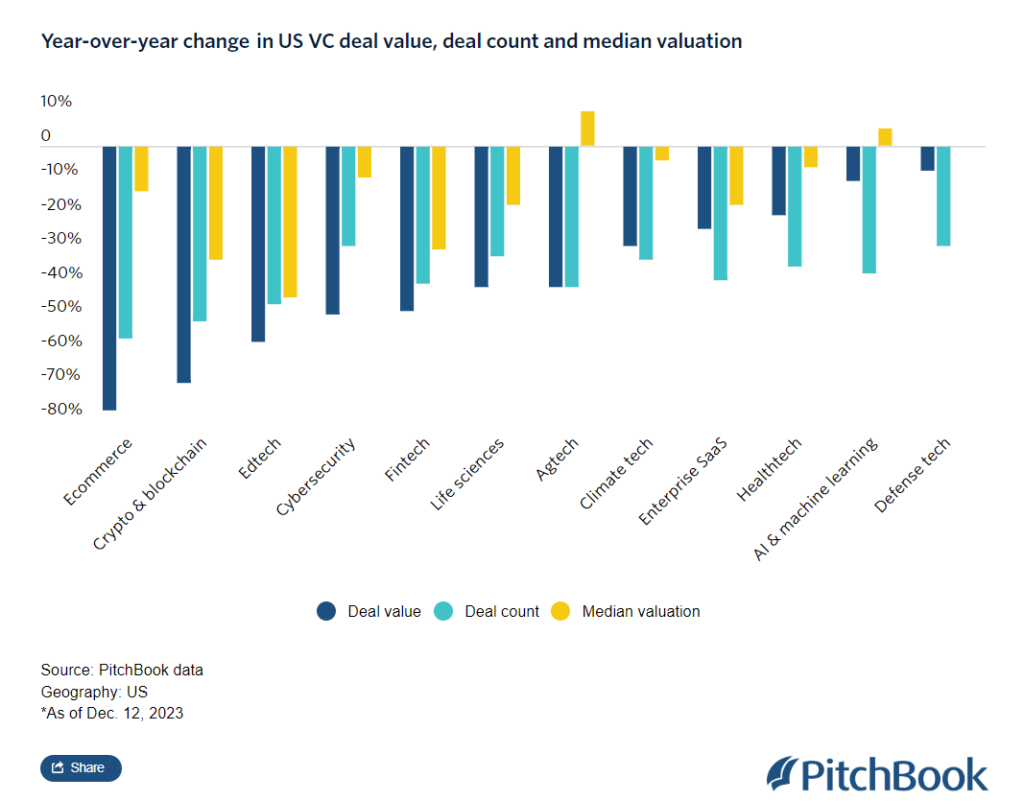

In this chart (below) from Pitchbook looking at sectors in terms of deal value, counts, and median valuation, we might notice AgTech’s median valuation jumped 10% YOY, AI/ML’s median valuation increased by 5% YOY, climate tech’s valuation also held up better than others, but Defence tech has the minimum decrease in deal value and counts. National security became a concern amid the technological arms race with China and wars in Ukraine and Israel.

The success of companies such as Anduril and Palantir showed investors that a more significant portion of the Pentagon’s growing budget could be captured by VC-backed startups rather than traditional defense contractors such as Lockheed Martin and Raytheon. US President Joe Biden has just signed the $841bn Defense Spending Bill for FY24, with an added focus on research and prototyping in areas such as missile defenses, hypersonics, space domain, etc.

US-based companies in the category collected nearly $100 billion in VC funding from 2021 to now, a figure that’s about 40% higher than what was invested in the seven prior years combined, according to PitchBook data. (Go deeper: 2023 Vertical Snapshot: Defense Tech) And New York Times has identified at least two dozen venture capital, government contractor financing or private equity firms that are run by or have hired former Pentagon officials or retired military officers, with most of the hires having taken place in the last five years.

A Profound Reset of the VC Industry

Quoted from the CEO of Techstars: “What the VC industry is currently going through is not cyclical, but a profound and unprecedented reset. Nothing in the data, or anecdotally in my own conversations with LPs, VCs, our corporate partners and Techstars portfolio companies suggests that a rapid V-shaped bounce-back is on the horizon…. rather than a prelude to a recovery, 2024 will be much more of the same. Her predictions for the VC industry in 2024: (Read the whole letter here)

1 – U.S. family offices will increasingly invest directly in startups. 😎

2 – There will be fewer VCs and unicorns. 😉

3 – Regulatory complexity will become a thing for VCs. 🤔

4 – The best accelerators will become more pertinent. 🤗

5 – Alternative venture models will come to the fore.” 😶

Lots of data indicated that small funds have better performance than large funds, but smaller funds will struggle more to raise funding in this climate. And, the unit economics of small/micro VCs is challenging to cover all aspects needed. New models might be emerging.

Global League

This is Jessie Chuang with Global League – a vetted network for professional or accredited investors to identify the most impactful ventures for impact investing.

We’ll resume ClimateTech Investor Panels in January 2024, and look forward to highlights on top investment opportunities. Recommendations on speakers – investors, experts, or startups – are welcome. Here are January’s topics:

- Sustainability of Built Environment (Jan 12)

- Sustainability of Food Supply Chain (Jan 19)

- Sustainability of Water and Ocean Tech (Jan 26)

Green buildings startups are buckling the trend with $5.3B raised in 2023, on track for their best year ever and marking a threefold increase from 2020. (from Urban Tech report by 2150 x Dealroom) We will cover this in the next newsletter.

Join Meetings or Get Recordings

Connect with me on LinkedIn for more news, shoot me an email, or book a meeting with me. Unsubscribe from this newsletter at the bottom, or share it with others for them to subscribe here. You can read our previous newsletters here on LinkedIn.