As diversified clean energy sources are being built, how to orchestrate different and distributed energy sources? The biggest challenge in the energy transition could be the infrastructure supporting the transition of electrifying everything. This topic is prioritized in our panel planning before we dive into other sub-sectors, related topics include VPP (Virtual Power Plant), V2X (EV battery as an energy storage/source), DER (Distributed Energy Resources), grid optimization, etc. We found recent news speaks the same priority. From Pitchbook’s Q3 2023 Clean Energy Report, the grid infrastructure segment received the highest VC funding in Q3 2023, with 41.5% of total deal value for the quarter. Insight Partners also identified “Grid decarbonization and optimization” as the very top opportunity among the 4 promising areas of climate tech investments (the writing is here).

For the whole picture, new infrastructure establishments also include other elements beyond grids – data, governance, community, financing, portfolio building and integration. Texas, the epic center of climate tech innovations, is an interesting example to discuss. Not only does Texas have its own system and governance, but everything is bigger in Texas, including its electricity use, which is increasing at historic rates in a sign of what is to come for much of the U.S. The country’s largest electricity producer and user saw sales growing at five times the national rate for the past decade! (according to Wall Street Journal) The solar and wind energy scales in Texas are both number one in the nation, and Texas has started to pilot ADER with the Tesla Powerwall. We invite a founding member of CleanTX, Thomas Ortman, an energy industry executive and technologist, to share his insights on a clean and optimized grid. The scope is beyond Texas.

To look at this topic from an investor’s lens, we invite Bob Bridge, the founder of SWAN Impact Network and co-founder of the Semilla Climate fund. He said — There are a diverse set of players contributing to the energy transition: federal and state governments, grid operators and regulators, established multi-national and national system vendors, installation and service companies, manufacturing companies, technology startup companies, universities, and more. Each player plays a different role. Where are the most interesting opportunities for startup companies and their investors?

Speaker

Bob Bridge, Founder of SWAN Impact Network and Co-founder of the Semilla Climate Fund – Bob has extensive experience in founding and taking early-stage technology start-up companies to successful exits, having been in startups that returned $430M to investors, and previously raised $60M for the companies that he founded. He had served as a VP and General Manager of a division of a public company.

Thomas Ortman, President of Nous Energy and Founding Partner of CleanTX Foundation – Thomas has forty years in the engineering design and build sector with electro-mechanical engineering design expertise in electronics, clean technology & semiconductor products, and capital equipment experience. He founded Concurrent Design, Inc. which led to a merger with Voltabox of Texas, Inc., and he turned into CTO of Voltabox of Texas.

Host: Jessie Chuang – Jessie is a deep tech startup advisor and investor, and the managing partner of Global League – a vetted network for accredited/professional investors to collaborate on deal evaluation and syndication, to identify and help the most impactful ventures. Her previous experience includes semiconductor frontier R&D management and global consulting on digital transformation and AI.

About CleanTX Foundation – CleanTX is an economic development and professional association for CleanTech and renewable energy businesses. Its mission is to modernize the power grid to advance renewable integration through industry collaboration and strategic alliances through chapters throughout Texas. Its vision is to achieve 50% renewable energy integration in ERCOT by 2030.

About SWAN Impact Network – SWAN is a 501(c)(3) non-profit with a network of angel investors focused on investing in companies that aim to deliver measurable social or environmental impact, and who also have solid plans for financial success.

About ClimateTech Investor Panels – This is for accredited private equity angel investors, venture capitalists, and corporate/institutional investors to share insights and investment opportunities and catalyze collaboration to help ClimateTech startups.

Sign Up to ClimateTech Investor Panels

Takeaways:

Bob

I spent a lot of years in hard tech (a lot in startups and semiconductors). I always have a deep concern about our environment and people being cared for, so I created SWAN Impact Network, an angel network of 85 members, we’ve invested about 14 million in startups, a bulk of which is in climate tech. So we also put together a climate tech fund. We are very selective, and we are well-connected in the Texas climate tech community, also we have a lot of support for companies founded by underserved people.

About market opportunities, what we don’t like are – battery chemistries (too many of them, it might take 15 years for them to realize an impact), direct carbon capture technology (is interesting but not for seed companies), marketplaces for greener consumption, and companies relying on government subsidies or a low-interest rate. What do we like? We like industrial or commercial applications, for example, reducing carbon emissions at the sources, increasing energy efficiency in buildings or factories, more cost-effective ways to treat water, and treating pollution. We prefer companies that don’t require a lot of Capex by users.

ERCOT in Texas allows new energy generation to come out (to users) even if there is no transmission capacity to move that electricity around – a unique situation in Texas. Companies can forecast usages, and optimize grid operations with renewables are interesting. Batteries are important, but it’s very difficult to bring a new battery with new chemistry into scale (not our interest). One of our portfolio companies installs solar panels integrated with batteries, which are doing very well and will integrate into VPP in the future.

Thomas

I spent my entire career in technology development, and new product development, including a lot of semiconductors which led us to a lot of solar and wind energy, some microgrids, and ultimately into batteries, then my company attracted interest and acquisition by the European enterprise Voltabox. I have been very active in the CleanTX Foundation for several years to promote clean energies, I also was asked to serve as EIR in Austin Technology Incubator to help startups.

What are the general megatrends of this energy transition? Humans spent 140 years to build the biggest system (of energy grids) in history, and now we are revamping it to add a lot of technologies. A lot of opportunities are about efficiency because the current grid is very inefficient. We (at Texas) designed the ERCOT grid to be able to satisfy the peak loads.

About energy storage, the largest storage medium on grids now is hydroelectric power. We also have compressed air energy storage, flywheel technology with kinetic energy storage, gravity energy storage, and superconducting magnetic energy storage (storing electricity), …… there are a lot of options.

VPP (Virtual power plants), DER (Distributed Energy Resources) and V2X are closer to reality than most people realize, worth a rigorous study for investment potential. The timing of them becoming mainstream is now! In ERCOT, we have 2 ADER piloting now which is the same thing as VPP, 8 ADERs have been authorized, in total they have megawatts of power generation on demand which are also emergency backups for any blips in the grid. This is a great opportunity that all of us can participate in, it will happen very quickly. Texas and California are very proactive in this, California also has ADER piloting. After one year through 4 seasons, it’s possible the mess participation and consumption can be opened to all. 3 years from now, people will be well aware of it, and it will become common in 5 years.

The biggest pain point in Texas is transmission, current transmission lines are fully subscribed, no more capacity for serving ever-growing peaks. So, batteries are crucial. A number screamed at me – in 2023 April, California had 700k megawatt-hours of renewable energies wasted (curtailed). Tesla has sold more than 4 million vehicles, each has a 65 kilowatts battery. If you aggregate those and make them available to the grid, that’s a greater capacity than the generation from the whole nuclear fleets in the entire U.S. The concern about extra cycles of discharging-recharging caused by participating in V2X/VPP is going away now.

Food for thought: (maybe opportunities exit)

Can we use those wasted renewable energies to produce green Hydrogen?

Current production and recycling of batteries are not very green, how can we leverage renewables?

How to motivate building owners, house owners, developers or communities to invest and participate in VPP, DER, etc.? (Economics calculation and finance engineering)

Watch the interesting conversation, questions, and answers in detail here. Thanks for the great questions, Tim, Chris, Paul and John!

Supplementary Information

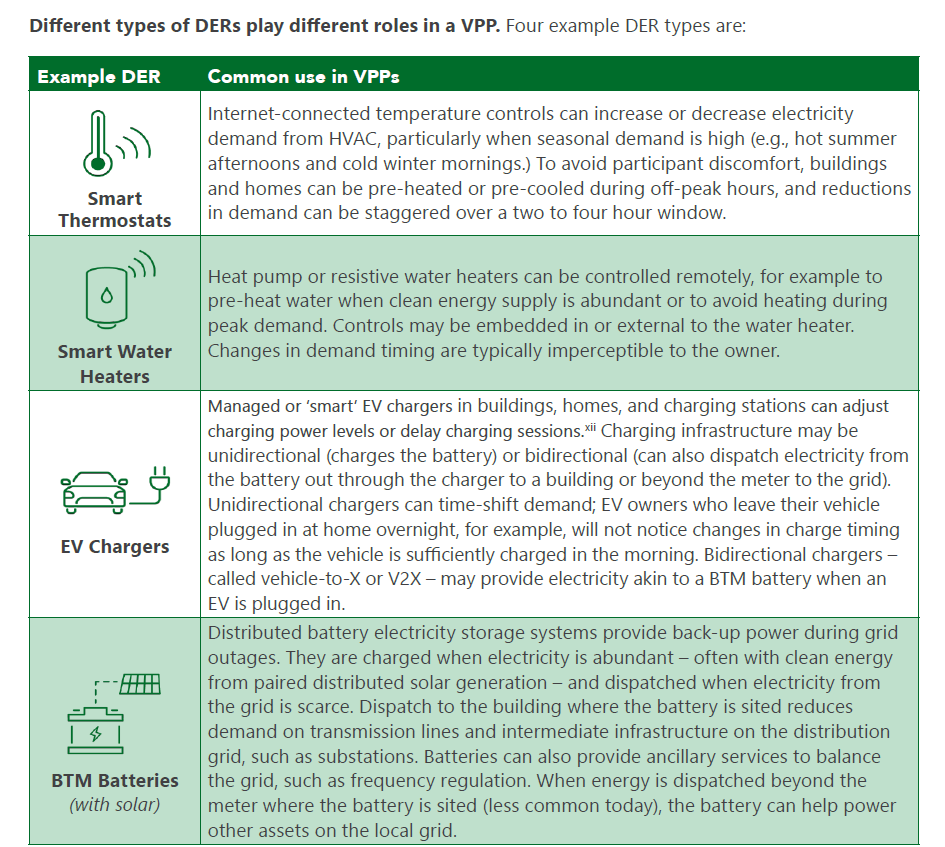

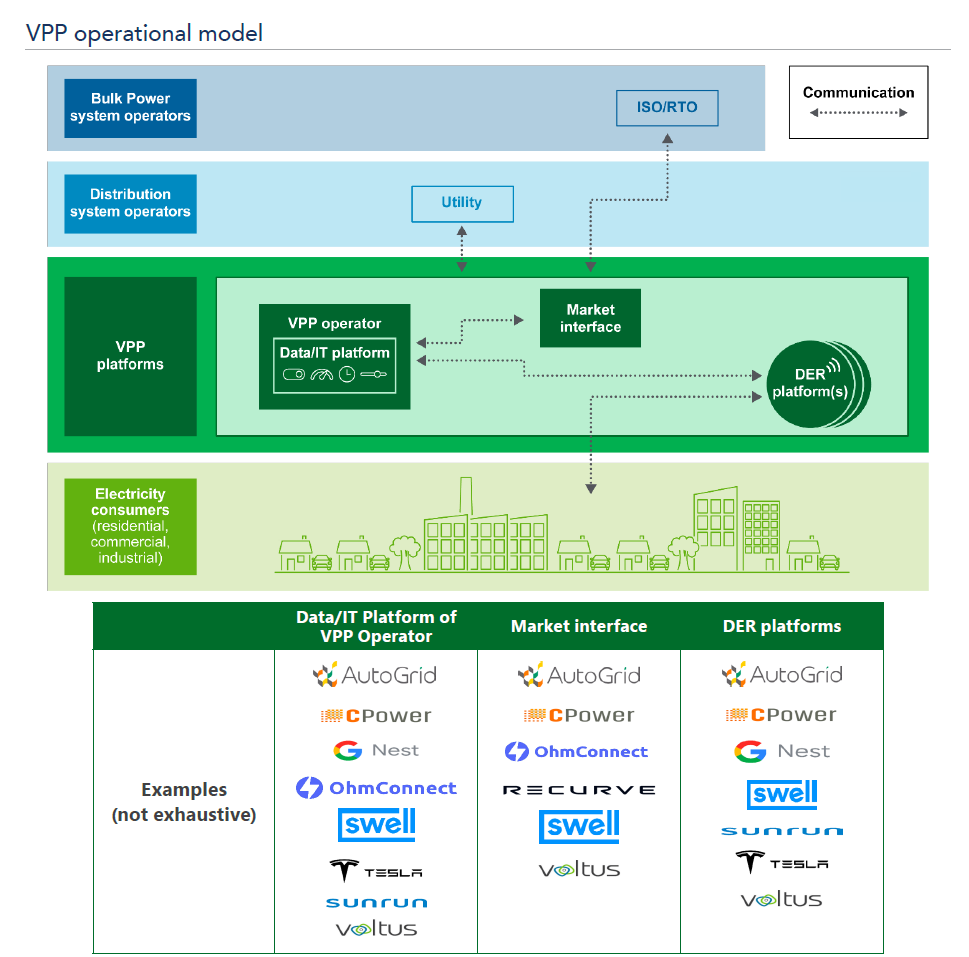

VPPs are aggregations of DERs that can balance electrical loads6 and provide utility-scale and utility-grade grid services like a traditional power plant.

DOE’s Pathways to Commercial Liftoff provides public and private sector capital allocators with a perspective as to how and when various technologies could reach full-scale commercial adoption. Check out the report about VPP. Some images from the report are used below to explain basic concepts.

What’s PACE? — The property assessed clean energy (PACE) model is an innovative mechanism for financing energy efficiency and renewable energy improvements on private property.

What’s Net Zero Energy Home? — A DOE Zero Energy Ready Home is a high-performance home that is so energy efficient that a renewable energy system could offset most or all the home’s annual energy use. Each DOE Zero Energy Ready Home meets rigorous efficiency and performance criteria found in the DOE Zero Energy Ready Home National Program Requirements.