Key takeaways

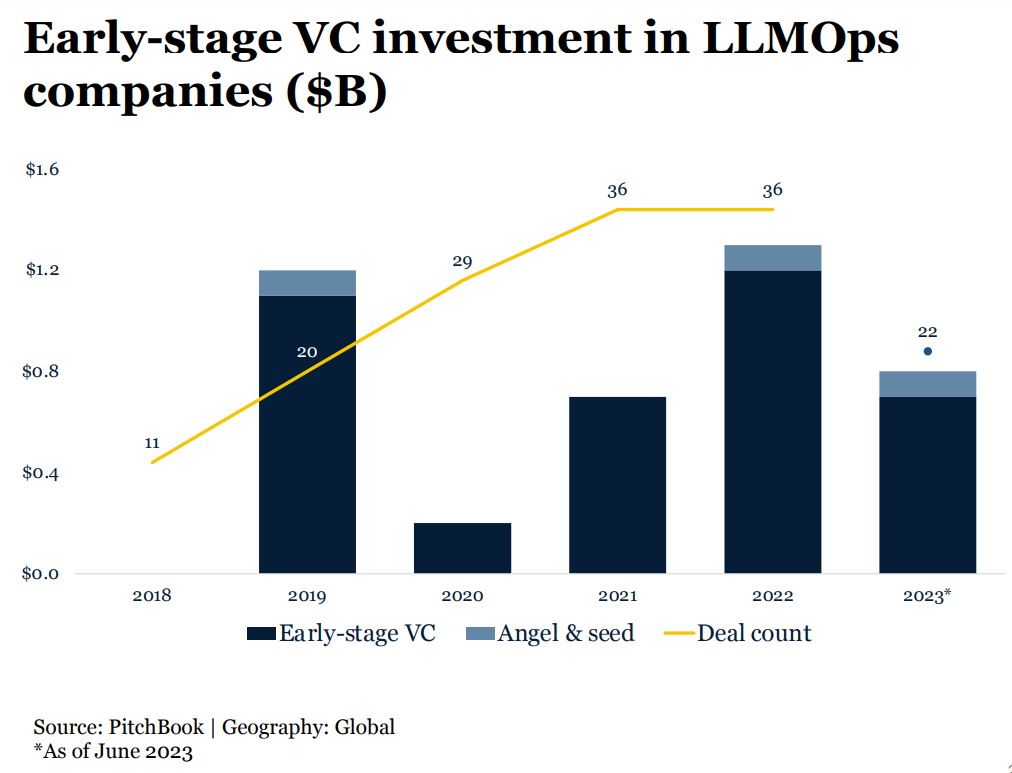

- Startup funding is shifting from generative applications to infrastructure solutions to support enterprises build internal tools

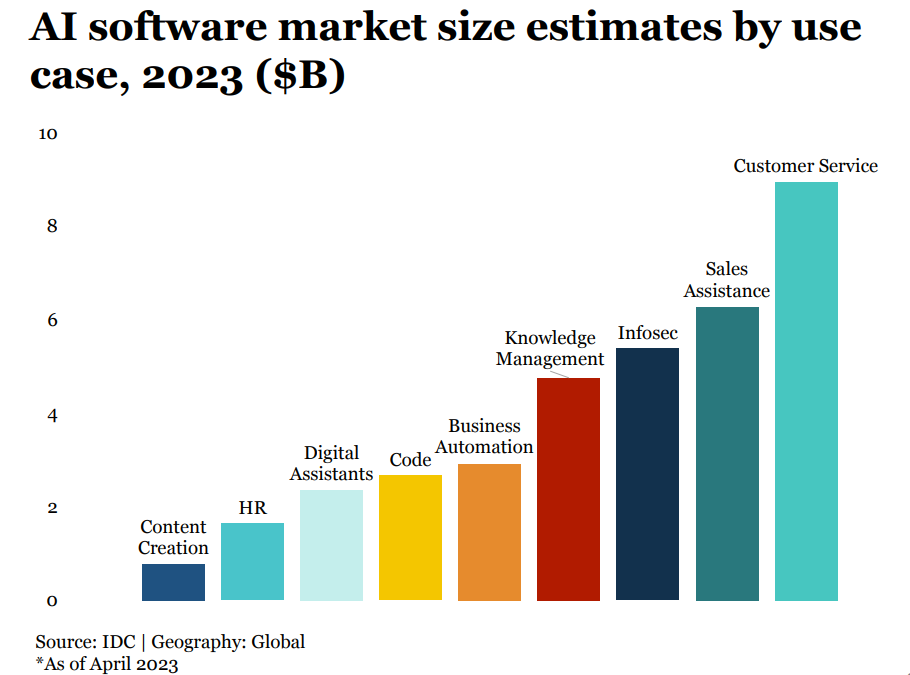

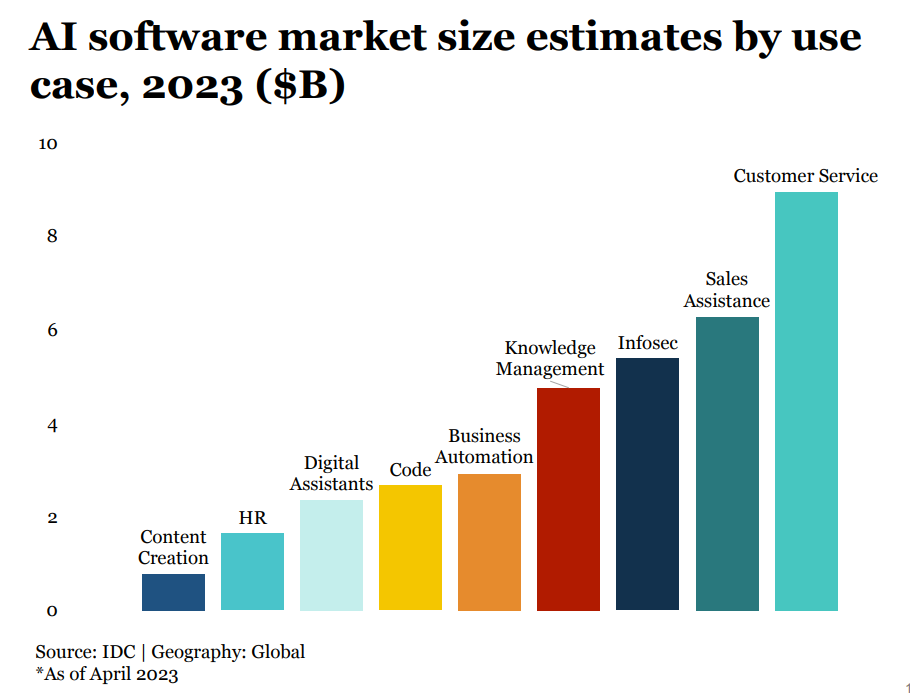

- Language use cases dominate enterprise spending and VC investment

- Emerging AI startups with short-term tractions are everywhere, investors need to understand their defensibility and profitability

Generative AI’s fast emerging market

The global generative AI market is expected to reach $42.6 billion in 2023. This sector is the top trend observed from where recent VC funding goes.

The early stage of a tech stack is emerging in generative AI. Hundreds of new startups are rushing into the market to develop foundation models, AI-native apps, and infrastructure & tooling. Models like Stable Diffusion and ChatGPT are setting historical records for user growth, and several applications have reached $100 million of annualized revenue less than a year after launch.

What has now become the critical question: Where in this market will value accrue? Where do VCs bet on? Take a quick look at the sub-sectors with bigger funding: (> $500M in total)

Investment in infrastructure solutions stands out

AI development infrastructure:

- AI applications creation and productionization, e.g. AnyScale

- Run, tune, and deploy generative AI models on any hardware or in the cloud, e.g. OctoML

- Vector database for vendor search, to power semantic search, recommenders, and other applications that rely on relevant information retrieval., e.g. Pinecone

AI data labeling, curation, and model integration:

- Automated data labeling, integrated model training and analysis, and enhanced domain expert collaboration, e.g. Snorkel

- Generative AI architecture to integrate foundation models and all models, full stack for enterprise AI, e.g. Scale AI

In the following chart from Pitchbook, the trend of early-stage VC investment in infrastructure solutions and data platforms going up is very strong against the backdrop of the overall financing climate downturn.

Breaking down the funding flowing into different capabilities in LLM infrastructure shows a lot of new startup categories are forming, including vector databases, prompt engineering, LLM model architecture, LLM orchestration, and LLM deployment, though winners are not yet clear.

Talking about AI infrastructure, everyone knows AI chips underlie all AI computing, but semiconductor is an area with a higher barrier of knowledge and resources for most VCs (read more about semiconductor AI opportunity here), investing in the software stack layer makes sense for them. It’s also a long-term bet, but without starting investing investors don’t get the learning opportunities toward a 10x return.

Language use cases are the new focus in AI applications

Language use cases dominate enterprise spending and VC investment. Applications in sub-sectors like marketing and sales assistance, customer service, infosec, and knowledge management get higher funding.

Visual media and content creation:

- Content creation suite for marketing or the like, e.g. Jasper (B2B or B2C content creation tool without proprietary models)

- Video creation tool, e.g. Synthesia (it makes video production possible for companies without actors, cameras or studios.)

Audio:

- Summarization for meetings, e.g. Fireflies.ai

Coding:

- AI coding assistants, e.g. Kodezi

Natural language interface:

- Chatbot and assistants (interface with customers), e.g. PolyAI, Cresta

- Search and knowledge discovery, e.g. Glean

Investors seeking long-term winners

In 2023 January, a16z wrote:

The growth of generative AI applications has been staggering, propelled by sheer novelty and a plethora of use cases. In fact, we’re aware of at least three product categories that have already exceeded $100 million of annualized revenue: image generation, copywriting, and code writing.

However, growth alone is not enough to build durable software companies. Critically, growth must be profitable — in the sense that users and customers generate profits (high gross margins) and stick around for a long time (high retention). In the absence of strong technical differentiation, B2B and B2C apps drive long-term customer value through network effects, holding onto data, or building increasingly complex workflows.

In generative AI, those assumptions don’t necessarily hold true, since the technology itself might change the market dynamics. (read more here)

All moats on deck

Getting OpenAI to focus on a particular corpus and answer questions from that corpus is no longer hard for people with a background in building software solutions. Open-source resources are available to startups as well as incumbents. Emerging AI startups with short-term tractions are everywhere, investors need to understand their defensibility and profitability in either vertical or horizontal positioning. Due diligence and analysis in technology, business, and other kinds of moats are important.

Investors can ask the startup what LLMs they’re using, whether and how they’re fine-tuning, and what their plans are for developing in-house models. Vertical LLMs might replace horizontal LLMs. Insights and data in verticals are a strong moat. Also, investors can ask how well/fast their solutions are adopted by their target audience. User experience and real impact metrics must be delivered, for example, productivity enhancements, and error rate reduction. Even a 1% improvement times a huge business value is worth pursuing.

AI transformation in many verticals is exciting, some verticals might see faster changes than others. But those investors who pursue only fast growth might miss long-term profitability. Behavior change, trust from users, organization change management (workflow change, value chain change…), regulations, physical limitations, relationship building, and other factors might create friction for AI adoption, but overcoming a barrier might become a moat that sticks for long. Last but not least, investors and startups need to watch the market landscape to prevent working on something that tech giants might come in later and take it away.

Reference:

Q2_2023_Emerging_Tech_Future_Report_Generative_AI, Pitchbook