by WiseOcean | Oct 28, 2023 | Climate Tech, Venture Investment

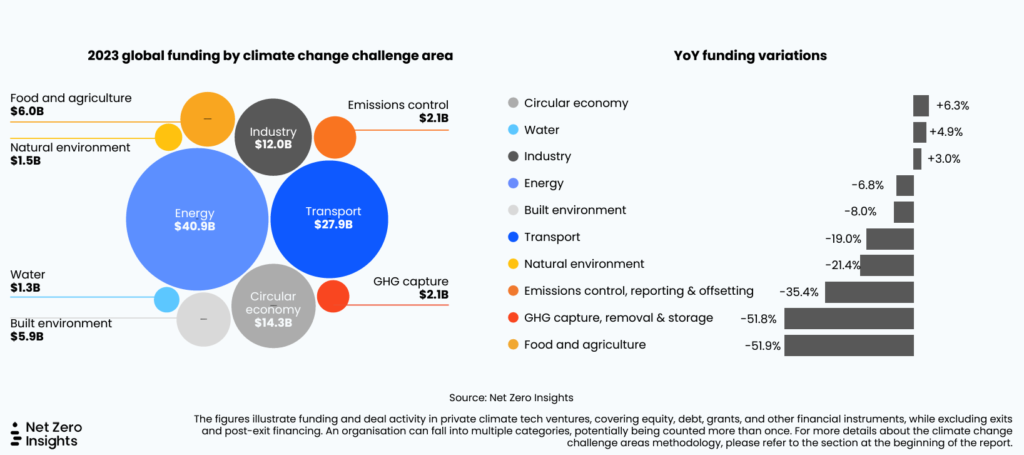

Half of the largest European venture capital deals in Q3 involved climate tech startups as the sector has seen less severe declines than others in VC dealmaking. A total of €9.1 billion (around $9.6 billion) was invested across 748 deals in the first 9 months of this year, according to PitchBook‘s Q3 2023 European Venture Report. This represents a fall of 42.8% for deal value and 38% for count compared to 2022. (FinTech and Software saw >70% declines)

Jørn Haanæs, Investment Director and Partner at Katapult VC (HQ in Norway) shared his view on climate tech with us on ClimateTech Investor Panels.

Katapult VC is a global investment company focusing on early-stage impact-driven technology startups. Over the last 5 years, Katapult has made 169 investments in impact tech startups from 47 different countries. Katapult invests within three investment verticals: Ocean-, Climate- and Food-tech. Katapult has run nine flagship accelerator programs and three corporate accelerator programs. Jorn has been with Katapult for about 3 years managing the climate fund, has reviewed 1000+ and interviewed hundreds of startups every year; before this, he was a successful entrepreneur who exited from his B2B software startup. He believes the climate challenge is the most pressing challenge for humans, and also will be the most profitable opportunity.

Interviewed by Jessie Chuang, the interview questions include:

Major public investments (procurement) and policies driving ClimateTech private investment momentum in Europe, and the timeline of impact.

Which nascent sub-sectors of climate tech have the most promising potential? (What sub-sectors are too crowded?)

How do you identify and evaluate them during diligence? (Invest after PMF, revenue?)

Please introduce Katapult and talk about your previous and recent investments and portfolio-building strategy.

What companies in your portfolio are growing faster than others? Lessons learned? Does impact investing sacrifice return for impact?

Takeaways:

In the climate tech space, we usually look at energy, mobility, cities, and enabling technologies. Cities and urbanization (urban tech stack) are the driving forces for reducing CO2 footprints. It relies on companies and consumers to adopt new innovations better than the previous ones, so you must make better or cheaper products. Climate tech needs to make its unit economics work.

Now the regulatory framework driving this is strong, but we mostly invest in B2B, less in B2G. CO2/externality taxing has started to influence the market to recognize climate tech startups, and we need to respond.

For seed-stage investors, we need to look at a very large number of startups and invest in a portfolio of enough deals in different opportunities. The power law is true in the early and later stages. Finding winners is much more important than negotiating the price. Identify winners and invest early, make them ready for series A investors, and we’ll generate returns.

The acceleration model after investing has been proven to be very effective and valuable, startups can fix their most important problems during the program (note: it can be remote). Katapult’s portfolio companies have a very high survival rate of startups – only 23/169 failed.

Overall Katapult has an average net IRR across funds of around 41%, which proves that the financial return of impact investing doesn’t need to be compromised. Actually, returns come from impact! Impact investors are different from philanthropy investors, and should not sacrifice returns for impact.

Katapult started as an impact investor in 2017 backing startups working on both social and climate issues, no one was doing that back then. These companies need much more than capital, and Katapult’s main value is connecting them with knowledge, networks, and opportunities, also helping them understand, classify, and communicate their impacts to drive value creation. Both Africa, Ocean, and climate funds are built from insights identifying under-invested areas, and applying the same method to invest and grow.

We invest in mostly revenue-generating companies, revenue-generating isn’t product-market-fit (PMF), and most seed companies don’t have PMF. We try to help startups understand how to run structured experiments to get to PMF. There are two very important distinguishing factors that de-risk startups: the first is closing the first customer to have revenue, and the 2nd is making sure you have quality revenue, don’t scale too fast, and continue to do experiments.

The boom and bust in previous clean tech cycles are faults of our financial system. We are going to decarbonize the entire economy, the opportunity is huge! The first order is energy since it goes into everything else.

About ClimateTech Investor Panels – ClimateTech is hard for investors not only because it’s mostly deep tech, but also because the variables for unit economics and adoption readiness are evolving. We interview one ClimateTech investor every Friday, a 30-minute Zoom meeting without live-streaming, we’ll do a briefing after every interview to be shared with broader networks. Join Zoom meetings to talk to speakers, or invite others to join the conversation/follow insights (Sign up).

by WiseOcean | Jul 5, 2023 | Venture Investment

After we discussed the process of decision-making in angel networks, let’s look into the processes of VCs.

Harvard Business Review had done a survey and interviews with the vast majority of leading VC firms. Specifically, the team asked about how VCs source deals, select and structure investments, manage portfolio companies post-investment, organize themselves, and manage their relationships with limited partners. There were responses from almost 900 venture capitalists — making the study the most comprehensive to date.

They found that…

Even for entrepreneurs who do gain access to a VC, the odds of securing funding are quite low. Our survey found that for each deal a VC firm eventually closes, the firm considers, on average, 101 opportunities. 28 of those opportunities will lead to a meeting with management; 10 will be reviewed at a partner meeting; 4.8 will proceed to due diligence; 1.7 will move on to the negotiation of a term sheet with the startup; and only one will actually be funded. A typical deal takes 83 days to close, and firms reported spending an average of 118 hours on due diligence during that period, making calls to an average of 10 references.

Though VCs reject far more deals than they accept, they can be very aggressive when they spot a company they like. Vinod Khosla, a cofounder of Sun Microsystems and the founder of Khosla Ventures, told us that the power dynamic can quickly flip when VCs become excited about a start-up, particularly if it has offers from other firms.

As the investment climate has turned investor-friendly this year (2023), this panel will interview VCs about how their investment funnels and decision-making process are structured, with a focus on deep tech startups.

Topics:

Introductions of Lam Capital/Research, SOSV, TINVA, Ceres Capital and their missions and stages of startup engagement/investment

The process of deal sourcing, evaluation, due diligence, decision-making, negotiation and more in different VC firms

The most important considerations and their priorities for decision-making in different VC firms

A good company and a good deal, what’s the difference?

The involvement and exit strategies after investing in startups

The prioritized innovations/solutions you are looking for from startups now

Advice for deep tech startups to build a relationship with you as well as fundraising preparations

Whether you are an entrepreneur or an angel investor, if you are interested in joining the conversation, and asking your questions to the panelists, including feedback on your startup, market insights, etc., sign up here. This is an invitation-only event. If you sign up, you can ask questions, and no matter whether you join or not, we’ll send you the meeting summary.

Speakers

Alexander Hall-Daniels – Alex is a program manager and had been a senior analyst with SOSV IndieBio’s New York office, a VC investment firm operating within biotechnology and life sciences. He has a diverse, global perspective cultivated from the wealth of international professional and educational experiences across the US, UK, and the rest of Europe.

Mike Huang – Mike is an investment manager with Lam Capital (Lam Research CVC), focusing on semiconductor manufacturing startup investments now. previously he has worked with Amazon, Samsung Electronics, and TSMC. He has an educational background in technology management and MBA from Taiwan and UK.

Yvonne Chen – Yvonne has over 20 years of success in telecom, security, MedTech, and early-stage investments and operations, including handling corporate investments at MICROELECTRONICS TECHNOLOGY INC., CDIB & PARTNERS INVESTMENT HOLDING CORP., H&Q TAIWAN CO., HTC CORPORATION, WI Harper, and Infinity Ventures. She has strong industry expertise and connections in Taiwan, Greater China, and Silicon Valley.

Jessie Chuang – Jessie is a startup advisor with US and international teams, a judge with Unicorn Battle and MassChallenge, an angel investor with several US angel networks, and an emerging venture fund manager. Her previous experience includes 10+ years in semiconductor R&D and team management at UMC, and another 10+ years in corporate consulting on digital transformation working with executives.

About TINVA

TINVA (Taiwan ITRI New Venture Association) is a Non-Profit Organization startup facilitator and venture builder that partners with various deep-tech stakeholders in order to provide startups with the resources, mentors, tools, and support needed in order to succeed. TINVA is associated with the top deep-tech research institute ITRI backed by the Taiwan government – the top source of deep-tech startups and innovations in Taiwan.

About Global League

Global League is an investor partnership with augmented collective intelligence built from a process proven by top angel networks with an average IRR >25% and 330+ exits. We connect quality investment opportunities from top US angel networks and VCs and collect intelligence from co-investing fellows.

About Founder Institute

The Founder Institute is the world’s most proven network to turn ideas into fundable startups, and startups into global businesses. Since 2009, our structured accelerator programs have helped over 7,000 entrepreneurs raise over $1.75BN in funding. Based in Silicon Valley and with chapters across 100 countries, our mission is to empower communities of talented and motivated people to build impactful technology companies worldwide.

About Wise Ocean

Wise Ocean builds up a global network to connect proven startups or scaleups, industry leaders, corporate innovators, ecosystem partners, and investors for impact and profit-making. For international startups entering the US market, we will help navigate US resources (partners or accelerators) matched to your needs, for US companies looking for Asia manufacturing or market partners, we have several partners that can help, such as TINVA.

by WiseOcean | Jun 20, 2023 | Venture Investment

Read the briefing of this panel here in our Global Venturing TL-DR Newsletter.

Early-stage investors are often long-term partners of startups. Angel investors usually write first checks to entrepreneurs before venture capitalists can commit. Beyond funding, angels can be mentors/advisors for founders. They are usually high-net-worth individuals with industry experience and connections, who can open doors (make introductions) for startups. There are different kinds of angel groups. In this panel, angel investors from Taiwan, Singapore, Indonesia, and the US will share their experience in angel investing and how they evaluate, invest and help startups. (panel talking in English, Chinese briefing will be provided)

早期投資是投資者與公司之間的長期關係,天使投資者通常會在機構風險投資基金投資新創公司之前給出第一筆支票。 除了提供資金外,天使還可以充當新創的導師——例如,提供商業戰略指導。 天使通常是高淨值人士,他們也可能擁有可以幫助新創的寶貴人脈。 在這個會談中,來自台灣、東南亞和美國的天使投資人將分享天使基金或天使網絡的運作方式,以及他們如何與新創合作以幫助他們成長。台灣新創進入新的市場,等於在該市場從零開始,天使投資人可能是很有幫助的夥伴。(英文對談;中文重點翻譯)

話題

- Introduction to angels and angel networks / 天使投資人和天使網絡有哪些不同類型?

- How to find angel investors that are good partners for your startups? / 如何找到合適的天使投資人?

- How to raise funding from angel investors? / 如何向天使投資人募資?

- How do angel investors evaluate and invest in startups? / 天使投資人如何評估創業公司並進行投資?

- How might angel investors help and support entrepreneurs? / 天使投資人可能如何幫助創業團隊?

- What do you observe in the current angel investing climate? / 現在市場的天使投資與早期投資有何趨勢?

- What do angels expect to get from investing and supporting startups? / 天使投資人為何要投資與幫助創業團隊?

- What angel groups have created an average IRR > 25%? / 那些天使投資社群創造了平均 IRR > 25% 的成績?

- What are the secret sauce of successful angel networks? / 成功的天使投資社群有何秘訣?

- What are angel investors looking for in 2023? / 今年(2023) 天使投資人在找什麼投資標的?

- Introduction of Taiwan ITRI New Venture Association(台灣工研新創協會)、Central Texas Angel Network(美國)、Bali Investment Club(印度尼西亞)、Taiwan Global Angels。

Whether you are an entrepreneur or an angel investor, if you are interested in joining the conversation, and asking your questions to the panelists, including feedback on your startup, market insights, etc., sign up here. This is an invitation-only event. If you sign up, you can ask questions, and no matter whether you join or not, we’ll send you the meeting summary. 無論是創業者或天使投資人,都可以報名參加,跟這次會談者提問交流。只有報名取得會議邀請才能參加。如果你報名,無論是否參加,都可提問,我們會後將寄送會談重點摘要。

Speakers

Bryan Huang – Bryan is the Managing Partner of TaipeiLaw Attorney-at-Law and Co-founder of Taiwan Global Angels. He is a legal advisor for investment in China, Taiwan, and States with broad experience in all aspects of startup and venture capital, accounting, tax, and financial management. He is passionate about connecting Taiwan with the global community.

Joseph Liu – Joseph is a member of 3 angel networks, Central Texas Angel Network (CTAN), Tech Coast Angels (TCA), and Chemical Angel Network (CAN). He is a board director of CTAN. His investment portfolio is comprised of companies across Life Sciences, B2B Software, Hardware, and CPG industries. He has 5 exits and 30+ active companies in his portfolio. Joseph is working with Jessie on venture investment.

Michelle Kung – As the Chairman of the TINVA Singapore Chapter, she is currently assisting leading technology companies from Taiwan to enter into SEA markets through venture building, international funding, local market partnership, and governmental support. Michelle is an investor in tech start-ups in SEA and Europe. In addition to funding support, she continues engaging with the regional start-up ecosystem as a mentor/advisor/judge for start-ups and partners.

Tom Courly – Previously in management consulting, focussing on digital innovation and agile transformation, Tom now develops Indonesia’s Start-Up landscape, building the impact-driven venture giants of tomorrow with Bali Investment Club, angels, and founders. Tom is also a Strategic Advisor and Commissioner for many of BIC’s current and upcoming portfolio companies.

Jessie Chuang – Jessie is a startup mentor working with US and Taiwan teams, a partner at Network VC, a judge with Unicorn Battle and MassChallenge, and an angel investor with several US angel networks, and an emerging venture fund manager. Her previous experience includes 10+ years in semiconductor R&D and team management at UMC, and another 10+ years in corporate consulting on digital transformation working with executives.

About Foundersbecker

Foundersbacker is a unicorn factory in the circular economy industry. In other words, Founderbacker is an ecosystem builder focusing on the circular economy of food, cloth, and shelter; we call ourselves “Xiaomi in circular economy!”

About TaipeiLaw Attorney-at-Law

TaipeiLaw Attorney-at-Law stands with entrepreneurs and offers professional advice and effective strategies that do not backfire. We support clients on legal battlefields amid market competition. Our team includes attorneys and accountants fluent in Chinese, English and Japanese.

About TINVA

TINVA (Taiwan ITRI New Venture Association) is a Non-Profit Organization startup facilitator and venture builder that partners with various deep-tech stakeholders in order to provide startups with the resources, mentors, tools, and support needed in order to succeed. TINVA is associated with the top deep-tech research institute ITRI backed by the Taiwan government – the top source of deep-tech startups and innovations in Taiwan.

About Wise Ocean

Wise Ocean builds up a global network to connect proven startups or scaleups, industry leaders, corporate innovators, ecosystem partners, and investors for impact and profit-making. We are also building the Global League fellowship with global-minded investors for global collaboration.

About Founder Institute

The Founder Institute is the world’s most proven network to turn ideas into fundable startups, and startups into global businesses. Since 2009, our structured accelerator programs have helped over 7,000 entrepreneurs raise over $1.75BN in funding. Based in Silicon Valley and with chapters across 100 countries, our mission is to empower communities of talented and motivated people to build impactful technology companies worldwide.

Next Panel: How Deep Tech Startups Are Evaluated by VCs