by WiseOcean | Oct 16, 2023 | Climate Tech

The London School of Economics reports more than 5,000 national climate laws have been passed worldwide over the past dozen years. Leading the way: The U.S. Inflation Reduction Act (IRA), which directs nearly $400 billion to energy innovation. Carrots, sticks, and corporate voluntary actions to reduce their emissions, this ClimateTech wave is global and unprecedented, different from the previous “CleanTech 1.0” more than a decade ago. US people often think Europe is more advanced in climate actions and investments, but the U.S. IRA has claimed a leading position as a change maker now. Has it? Let’s take a deeper dive into the climate of ClimateTech’s public and private investments in both.

Speakers

Oct., 27th

Jørn Haanæs, Investment Director and Partner at Katapult – He is passionate about tech and culture, and how it affects everything around us. His background is in the tech and entertainment industries, in building entrepreneurial ecosystems (Startup Director of Oslo Business Region) and serving as a CEO for a VC-backed startup with exit (Soundrop). Katapult invests in global seed-stage climate tech. His mission is to facilitate entrepreneurs and help startups grow through impact investing.

Nov., 3rd

Juan Thurman, Director of SWAN Impact Network – Juan is an early-stage investor, board member of numerous startups, and the director of SWAN Impact Network, he is dedicated to helping early-stage clean tech and climate companies get to the next level. He’s a GP for a new ClimateTech fund.

Host: Jessie Chuang – Jessie is a startup advisor with US and international teams, an angel investor, and the managing partner leading Global League. Her previous experience includes 10+ years in semiconductor R&D and team management, and another 10+ years in corporate consulting on digital transformation and talent development technologies.

About Katapult VC

Katapult VC is a global investment company focusing on early-stage impact-driven technology startups. Over the last 5 years, Katapult has made 178 investments in impact tech startups from 47 different countries. Katapult invests within three investment verticals: Ocean-, Climate- and Food-tech. Katapult has run nine flagship accelerator programs and three corporate accelerator programs. In 2021, Katapult launched the Katapult Foundation with the aim of building a larger network around impact investing. Katapult also hosts the annual Katapult Future Fest in Oslo, bringing together founders, investors, and some of the most prominent figures within impact investment

About SWAN Impact Network

SWAN is a is a 501(c)(3) non-profit. The angels at the SWAN Impact Network are bound together by a passion for making the world a better place by supporting dynamic startups that are striving to address serious challenges that our society faces. SWAN focuses on companies who expect to deliver measurable social or environmental impact, and who also have solid plans for financial success. The SWAN Impact Philanthropic Fund allows both accredited and non-accredited investors to make charitable donations which are then used to invest in impact startup companies.

About Global League

Global League is a global investor fellowship to build a network of intelligence plus a decision-making process proven by top investor networks or VCs with an average IRR > 25%. We select startups from top seed investors(VCs/angel groups) and build a disciplined process to get collective intelligence for investments and venture building. Collaboration and co-investing are our core strategies to connect silos and amplify global impact on the health of humans and our planet.

About Wise Ocean

Wise Ocean builds up a global network to connect proven startups or scaleups, industry leaders, corporate innovators, ecosystem partners, and investors for impact and profit-making. For international startups entering the US market, we will help navigate US resources (partners or accelerators) matched to your needs, for US companies looking for Asia manufacturing or market partners, we connect with Taiwan partners.

About Enventure

Enventure is a holding company with subsidiaries of PE, VC, consulting, and non-profit entities that serve different investment methods, sectors, and audiences to empower businesses with capital, unparalleled strategic insights, and a specialized network. Our approach is uniquely hands-on, providing end-to-end investment & consulting services.

Note: Interview questions will be collected and shared with speakers before panels, briefings and recordings of panels will be shared with broader networks afterward. Sign up to get meeting invites or briefings/recordings.

Sign Up

by WiseOcean | Oct 12, 2023

ClimateTech Investor Panel Every Friday, 10 AM, US Central Time (30 min. Chat) Investor Partnership This is for accredited private equity angel investors, venture capitalists and corporate/institutional investors to share insights and investment...

by WiseOcean | Sep 22, 2023

Fundraising checklist (suggestions curated by WiseOcean.Tech) Do or Do Not, there is No Try (in fundraising), usually a CXO needs to commit to it for several months, and at times the whole executive team needs to meet investors. When is the “right” time...

by WiseOcean | Aug 21, 2023

We all invest time and effort in what we believe, in what aligns with our identity, in something we feel comfortable with or excited about. Being an investor is similar. Not only institutional investors have investment thesis, but individual investors should also have their own investment thesis, starting from knowing their own investor character.

Do you like to participate in the decision-making process and selection or just select managers to do that for you? Do you enjoy helping startups you invest in or just learn along the way? Are you excited about the realization of frontier technologies or drawn to novel innovations? Are you only interested in something you can understand? Are you an impact investor that takes impact into consideration? Do you like long games with 10-100x upside potential or safer shorter bets closer to IPO/exits with smaller upside potential? Do you prefer to follow famous VCs when possible (usually more expensive valuation) or do you love researching and strive to be a smart investor?

Take a look at these examples, and think about which cases you’re more interested in learning more about. This isn’t solicitation, the purpose is to find what aligns with you better.

Pre-IPO Secondaries

The top blue-chip startups like Stripe, SpaceX, OpenAI, Instacart, Flexport, Notion, Epic Games, Discord, Airtable, and Databricks have created hundreds of billions in value in the private markets that are nearly impossible to access for non-institutional investors. Now that’s changed. Furthermore, the public market downturn brings many pre-IPO secondaries discounted 30-60% from their peaked valuation, but not for all though. If OpenAI is too expensive for you, Anthropic is a strong contender started by former OpenAI employees, who just raised $100m from SK Telecom, and $450m 3 months ago from Google and more. Secondaries exchanges give private investments and pre-IPO startup employees liquidity as well as participation opportunities for more investors. (read more here)

Follow Y Combinator (YC)

YC is the hardest accelerator to get into in the world, it’s said that the acceptance is lower than Harvard. Pitchbook gave a report on achievement comparison of renowned accelerators like YC, Techstars, 500 Global, MassChallenge, and SOSV in 2023 June. The report concluded that in terms of successful exits, capital raised within three years of completing an accelerator program, and cumulative capital raised, unicorn creation rates, YC led the pack in all. Selecting from YC-backed startups is one of our strategies, but not the only one. The next YC bach demo day is right around the corner.

Follow Top Angel Networks

Angel investors have become a special category of investors, not by check size and stage in the traditional sense, but by a more collaborative process for investment decision-making and venture building. There is more collective intelligence built up in the processes of top angel networks (hundreds of members) than in most VC firms with very lean teams. Some angel networks have built processes that have created “higher-than-average” IRR over long years of operation. And, in the U.S., angel networks share deals with each other, which means more data is collected. Angels are high-net-worth professionals and executives. Their insights and networks can be helpful in reviewing deals and helping with critical decisions in a startup journey but don’t handhold. They also have participated beyond angel rounds now. (more insights from our previous panel) Connecting top angel networks is one of our strategies.

Follow Industry-Leading Corporate VCs or Specialized VCs/Accelerators

Evaluating each deep tech startup is a deep case study, we need to understand the industry context, technical knowledge, business logic, and competition landscape. Fortunately, we might have the opportunity to leverage the brain power of corporate VCs or startup programs. Many industry-leading enterprises engage with early-stage startups possibly from TRL (Technology Readiness Level) 4 and up, they have the industry expertise to select startups and innovations with potential. For example, Shell and Halliburton run startup programs for many years. Similarly, specialized VCs and accelerators are sources to find gems in their focused domains. For example, SOSV specializes in bio/health tech and climate tech, and CIA-backed In-Q-Tel specializes in defense tech.

Follow Top VC Fund Managers with Top Track Records

Only top decile VCs create cash-on-cash returns to their LPs(limited partners, investors invest in VC funds) that beat other assets such as real estate or public market stocks. Real performances of VCs are very hard to find and verify, even if you do get their reports, often they use TVPI (ratio of the total value to paid-in capital) which considers both the realized and unrealized value of the investment, the latter is just value “on paper”. For example, if companies raised rounds during 2021, values were largely inflated and recorded “on paper” unless they raise a down run after that so the value is updated. Many fund managers touted their performances by TVPI, instead DPI (ratio of distributed value to paid-in capital) is the real return for LPs. On the other hand, VCs make a lot of big mistakes and herd behaviors, look at WeWork and Theranos, so don’t just follow big-name VCs because they are famous, research what they have done! (Go Google who invested in WeWork and Theranos)

Follow Major Forces and Tailwinds from Policies

Against the backdrop of macroeconomics, global trends such as the climate crisis leading to governments’ actions, geopolitics tensions leading to the localization of critical manufacturing capabilities and supply chains, defense tech, and semiconductor sovereignty, could create and shift investment opportunities accordingly. Examples of climate tech include green hydrogen, decarbonization and carbon-to-value tech, carbon market infrastructure, and carbon software. However many factors are at play and uncertain because of still-evolving developments and different timelines/policies in different countries. Using a top-down approach, for an emerging trend we often connect with industry experts in the trench to understand related variables, collect landscape data and market reports, and host advisory panels for deeper discussions around a topic. We might reach out to potentially promising startups identified through the research process. If interested, you can join our discussions.

Follow Your Calls

Everyone cares about some causes, be it saving the next generation from the climate crisis, improving equality and inclusivity in our societies, finding cures for diseases humans are suffering, or better healthcare models. Other areas of SDGs (Sustainable Development Goals) could be your calls, investments are crucial impact drivers, and you can put your money to work on that. Impact investing isn’t equal to inferior financial returns, on the contrary, impact-driven decisions are often requested by investors or stockholders.

Be a Smart Investor

Although angel investments have been democratized, angel investors need better intelligence to make better decisions. We see angels have absolute disadvantages in information and knowledge when looking at deals coming from current sources. Usually so-called “deal memos” are sales promotions filled with one side perspective – the selling side. We want to be smart investors being able to know as many variables as possible and ask questions. When making decisions we know what risks we are taking.

Be a Value-Add Investor

Being an active investor might help startups grow in many ways depending on your experience and connections. Many startups prefer to take capital from value-add investors. The help could include making introductions, advising on business strategies, company governance, capitalization, and exit journey. Bigger investors might become board members, while syndication of smaller investors can support startups by making introductions if needed. Investors are one kind of synergetic partner with a high conviction for startups. Besides financial returns, this can add learning opportunities about new innovations with first-hand updates to active investors.

Ideally, all kinds of investors need to build a diversified portfolio across industries, stages, and execution teams. The good news is that syndication enables investing smaller checks possible, any accredited investors can invest in private companies, even later rounds before they go public. We collaborate to share the cognitive loading and more data.

To join Global League – an open network to find the most impactful startups for impact investing – tell us about yourself for better collaboration if you haven’t filled out this form. There is no fee.

Apply to be a Global League Fellow

by WiseOcean | Aug 7, 2023 | Climate Tech

Achieving deep emissions reductions in heavy industry (cement, steel, and chemicals production) can be challenging for several reasons. Carbon capture, utilization, and storage (CCUS) technologies might be among the cheapest abatement options – or the only option. For example, in the case of cement production, where two-thirds of emissions are from chemical reactions related to heating limestone, CCUS is currently the only scalable solution for reducing emissions. And in the iron and steel sector, production routes based on CCUS are currently the most advanced and least-cost low-carbon options, the same in the production of some important chemicals such as ammonia, which is widely used in fertilizers. More policies are supporting the carbon capture adoption now. (read more in IEA writing)

The cost of CCUS might be reduced as the maturity and infrastructures are improved, but that needs heavier investments and longer time horizons, and maybe not be suitable for most VCs or angel investors. Capturing CO2 is cheaper if compared with converting it from its capture solvent into a purified tank which could be up to 10x more energetically and financially costly. CO2 storage or transportation will increase operating costs or logistics burdens, the cost varies widely (data reference here). It’s better if we can utilize the CO2 immediately to create some valuable products which can be sold to create income to offset the cost or even make profits. It’s part of the so-called Carbon-to-Value (C2V) – a fast-emerging and evolving category. It could be the most VC-backable sector within the broader circular carbon economy.

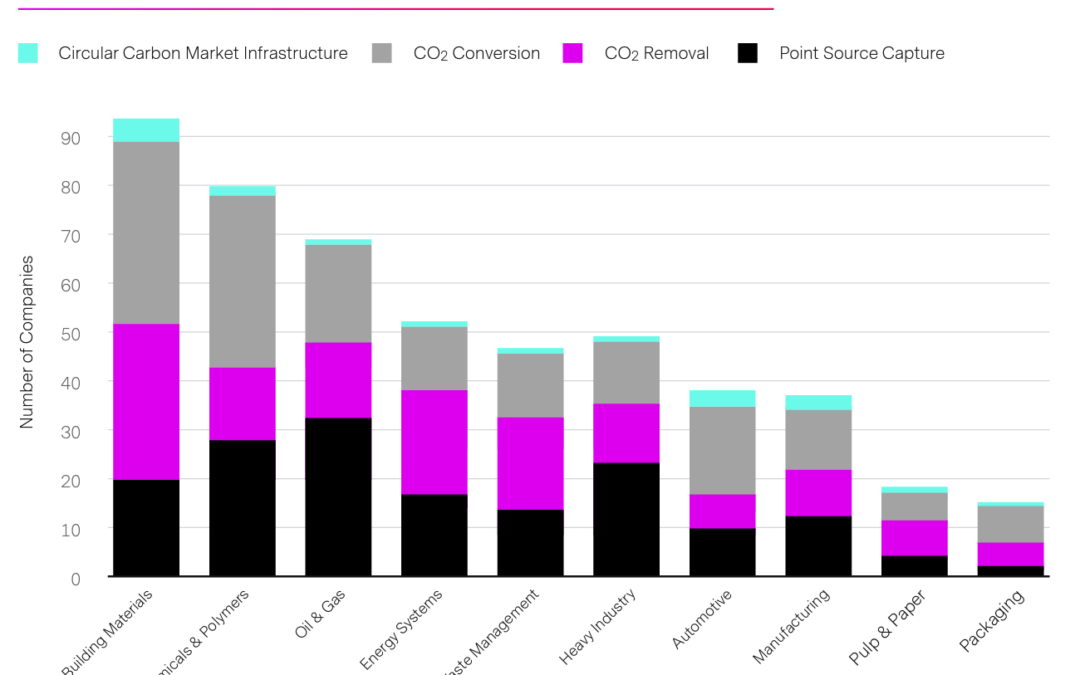

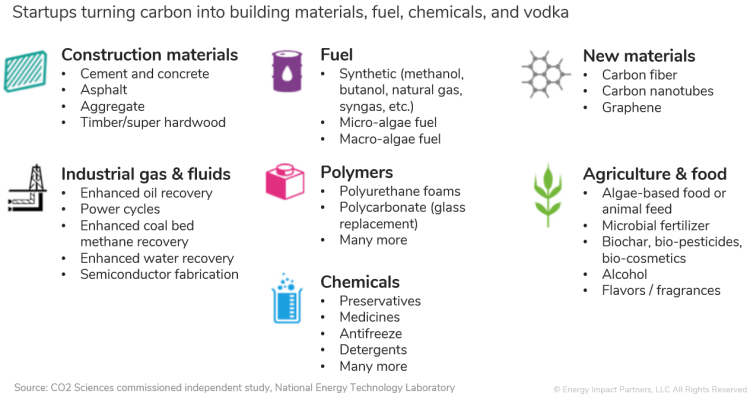

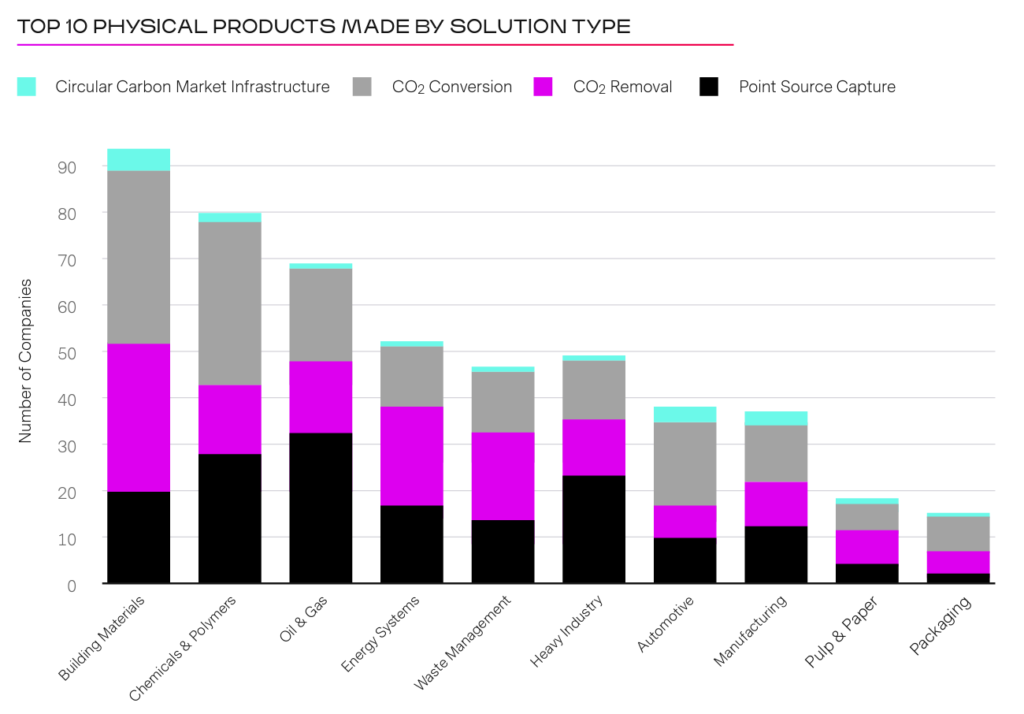

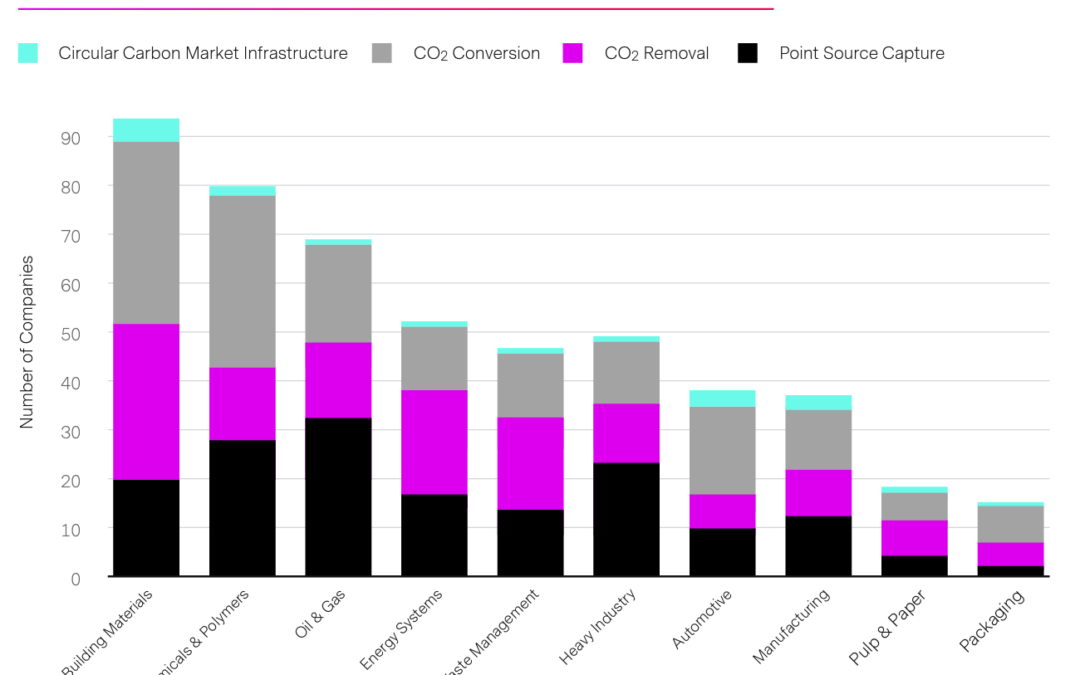

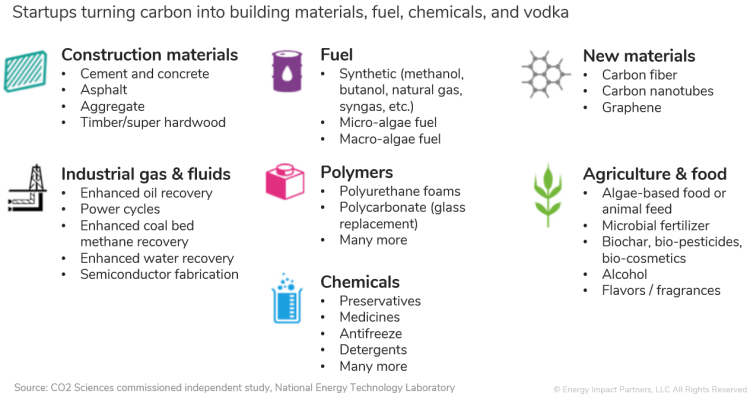

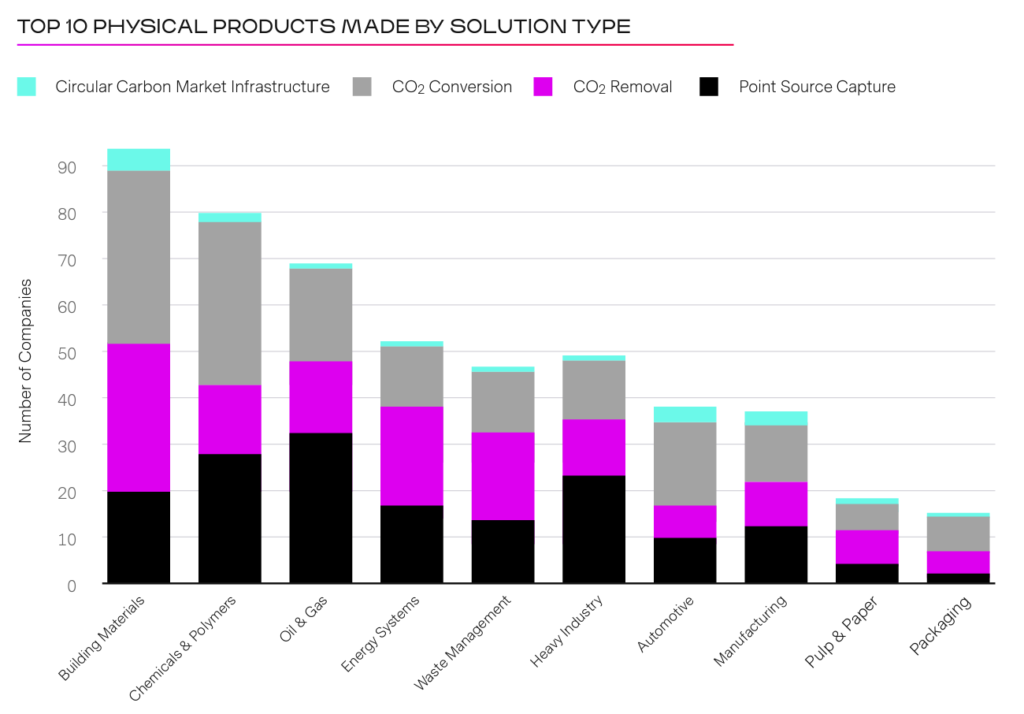

A significant amount of startups focus on carbon utilization applications, representing a very broad range of possible end products, from foods, and specialty chemicals to fuels and building materials, pictured below. There are 274 companies working on carbon conversion with some combined with other carbon solutions (removal, capture, etc) collected in Circular Carbon Network (an XPRIZE initiative) Circular Carbon Market Report of 2022.

Circular Carbon Network has been tracking new companies in the carbon space, over half of all carbon tech companies (52%) within their carbon economy index report make a physical product, either in combination with offset sales and tax incentives or as the single revenue driver. Hard-to-decarbonize sectors such as building materials, industrial chemicals, and liquid fuels will likely have the largest addressable markets (estimated at $5.6 trillion collectively). Ideal C2V solutions can plug into those industries currently lacking a pathway to decarbonization to turn carbon and other by-products into useful and valuable products. Besides, the industrial gasses, consumer goods, and biochar categories also have more than doubled in size since 2021, suggesting larger investments or demand growth for these categories.

Credit: Circular Carbon Network

Major challenges are unit economics and “cross-the-chasm” adoption. Despite a few initial adopters, corporates will be reluctant to purchase carbon-negative products purely for climate reasons. C2V products still need to be comparable or cheaper than existing materials and even then, many legacy industrial, building, or transportation companies are extremely conservative and unwilling to adopt new technologies given the scale and risk of their businesses, and some industries are regulated. Digging into different contexts including driving policies in different industries and getting opinions from industry advisors are needed in making investment decisions.

For example, the EU has passed a regulation to recognize e-fuel made from captured carbon and green hydrogen from renewable energy as carbon neutral. Without a doubt, e-fuel has a significant opportunity in the aviation industry for Sustainable Aviation Fuel (SAF) since there is not much choice. And, the Inflation Reduction Act (IRA) has transformed the SAF landscape, with the inclusion or expansion of at least three significant tax credits. As a result, many “low carbon intensity” manufacturing pathways can become cost-competitive with conventional jet fuel. Subsidies and tax credits are important, IRA tax credits are transferrable and stackable, which creates significant funding for clean energy producers. (dig deeper here)

Figuring out the financing path early is essential. Among several types of funding sources supporting these carbon tech innovations — government and philanthropic grants, project equities and debts, and private investors, funding for equities raised from private investors (PE/VC) and angel investors is the largest category. Many climate tech investors have been getting more active this year even in the overall market downturn. But there’s a huge gap between early-stage venture capital checks and the $200m+ DOE loan program scale checks, CTVC’s post on the bridge to bankability addressed potential options.

Strategic business models are very important in terms of capital efficiency. It will be very hard for startups to sell equipment or services to a slow-moving, thin-margin incumbent, especially if they need to pay upfront dollars. Building a new full-stack company doesn’t always make sense, particularly when the cost of capital is high. In the so-called clean tech 1.0 era (2006 ~ 2011), some 90% of series A investments failed to return that initial investment, per a 2016 MIT study. Of those that did succeed, market returns were found to be lower than comparable investments in healthcare or software. We as investors can learn lessons from clean tech 1.0.

Corporates need climate tech to meet their climate commitments. To accelerate decarbonization in hard-to-abate sectors, the World Economic Forum, the Office of the US Special Presidential Envoy for Climate, and Boston Consulting Group created the First Movers Coalition with 83 blue chip members that have committed to buy more than $12 billion worth of net-zero products. On the other hand, large tech companies such as Microsoft, Shopify, Stripe, and Amazon have all made decarbonization investments – either through a dedicated climate fund and/or incorporating carbon removal options to customers. Climate Action 100+, the largest investor initiative on climate change, has signed 700 institutional investors managing a combined $68 trillion in assets to commit to leveraging their power and influence to ensure the world’s largest emitters take necessary action on climate change. United Airlines even formed an investor alliance and Sustainable Flight Fund to support startups developing SAF. More than 4,000 businesses around the world are already working with the Science Based Targets initiative (SBTi) for goal setting of climate commitments. Of course, global governments set up regulations are the sticks – corporations are under pressure.

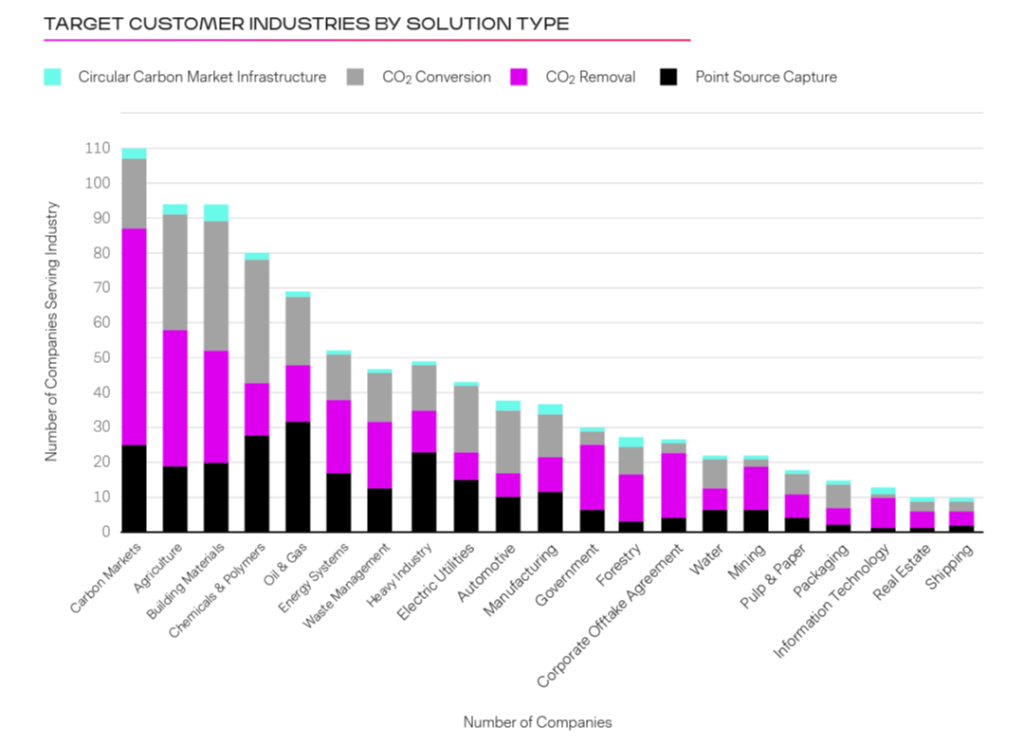

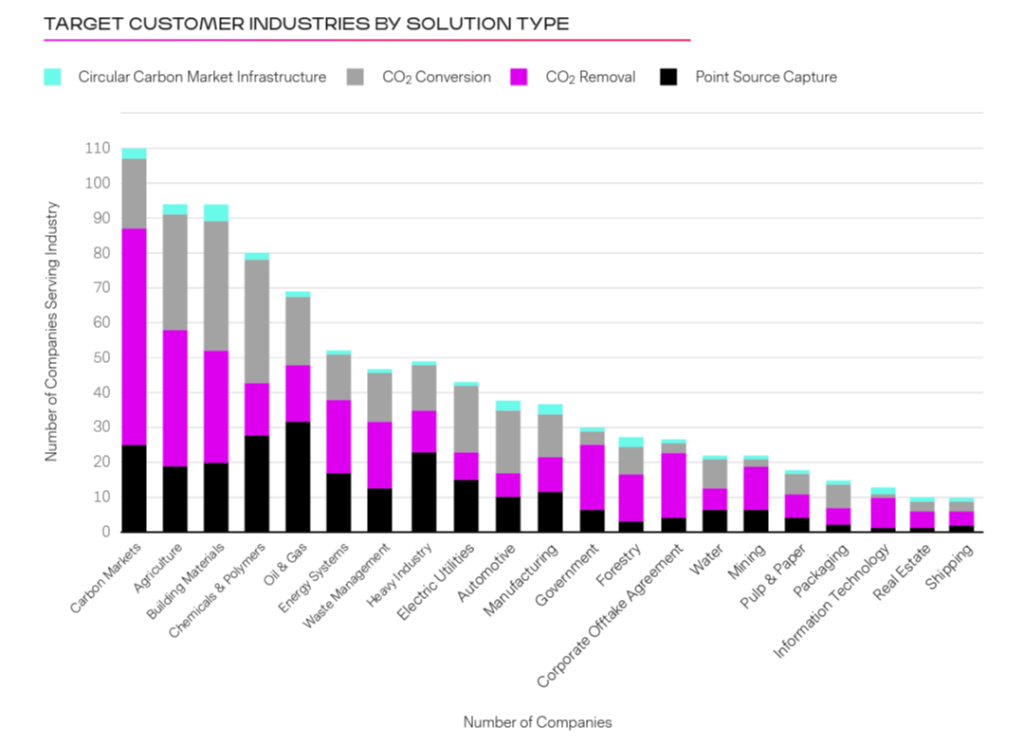

Carbon markets can help with carbon monetization to motivate the adoption. Circular Carbon Network surveyed companies about their target customer industry to further understand the potential customer bases of solution providers. In 2022 companies targeting Carbon Markets as a revenue stream made a huge jump to the top of the list as target customers for Circular Carbon startups, increasing 160% in responses. We’ll talk about the carbon market and software in the next post.

Credit: Circular Carbon Network

Join us for more discoveries and discussions on investment opportunities and risks in the emerging carbon economy.

Resource: Economic Feasibility for CO₂ Utilization Data Visualization Tool (from NREL)