Climate Tech Circle Time with Noah Miller, Founder & Chief Strategist, Rho Impact on 2022/11/23 at 9 AM CT

Our society desperately needs investments to reverse climate change, but there is no objective evaluation mechanism when undertaking due diligence with investment targets. Quantifying sustainability impact is critical for investors to better identify, evaluate, and communicate the technologies that will reduce emissions.

In this session, Jessie invited Noah of Rho Impact to discuss how they help Eclipse Ventures build up a framework for assessing the potential climate impact their portfolio could make, and share his observations on the recent developments from COP27, the Biden administration’s proposed plan to protect the federal supply chain from climate-related risks, and more from the landscape.

Note: The Climate Tech Circle Time is part of our Venture Council effort for Climate Tech venture building, in collaboration with Born Global Community.

Takeaways

Many greenwashing scandals and lawsuits show that lack of validation of ESG claims has been a serious issue; ESG disclosure regulations in major markets (US, EU, China) are influencing decisions in B2B customer acquisition and investment capital.

ESG disclosures inform everything from ESG raters to institutional investors/advisors to lists of the best ESG products for consumers. The implications in reputational, operational, and financial consequences for enterprises are significant in terms of investor and customer acquisitions, due diligence for M&A, loan applications, and insurance.

Because of Scope 3 commitments from major brand names, their suppliers must be able to provide and validate ESG data to do business with them. US Supplier Climate Risk Rule also requires suppliers report Scope 1, 2, 3 emissions, climate risk assessment alignment with TCFD (Task Force on Climate-Related Financial Disclosures), and emission reduction targets validated by SBTi (Science Based Targets Initiative).

COP27 has reached the “Loss and Damage Fund” deal. Explosive funding will be deployed to climate tech verticals – carbon capture, emission reduction, climate adaption resilience, sustainable food system, etc. at a global range. Especially there is a major focus and market opportunity in food tech.

An important reflection from COP27 is the lack of stakeholder engagement from all countries. In order to get broad acceptance, commitment, and deeper collaboration from all stakeholders, the process needs to be equitable as well as the outcomes.

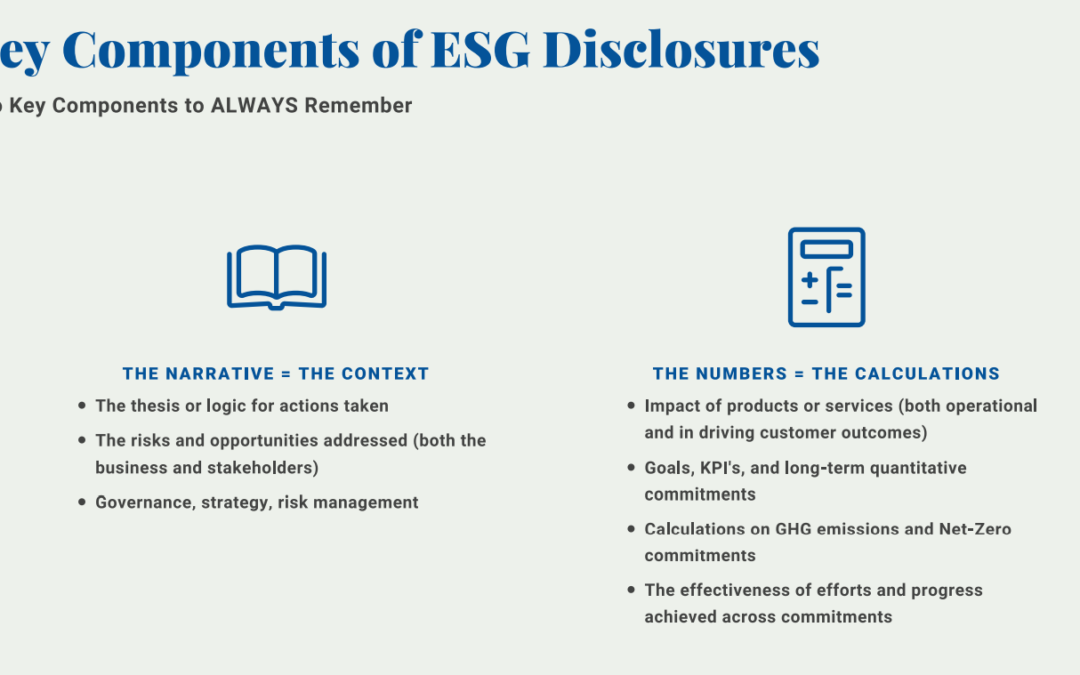

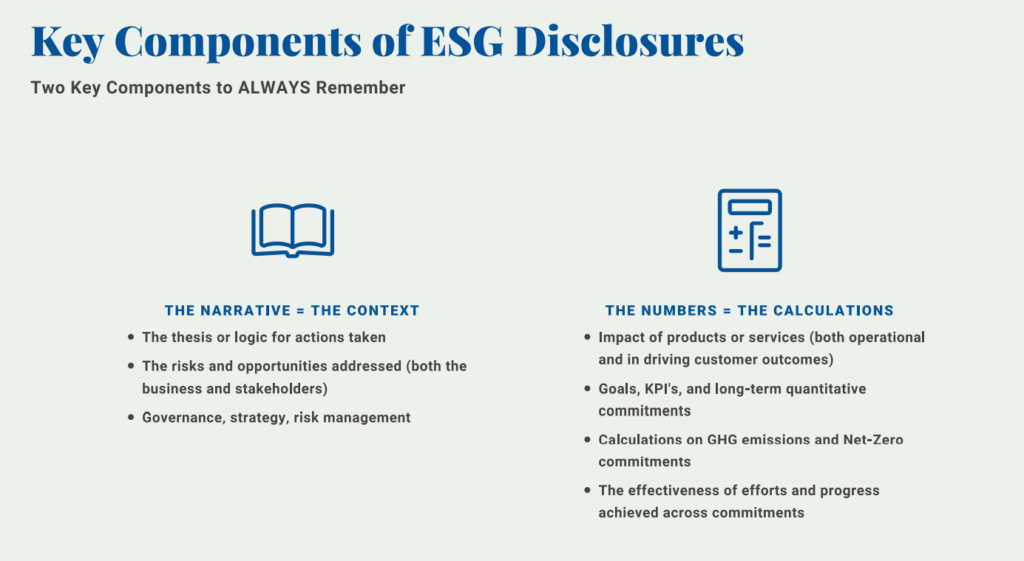

Key components of ESG disclosures include the narrative (the context including the thesis or logic of why you are doing what you are doing, the risk and opportunity you are addressing, the governance structure for overseeing the work, the overall strategy of business model and driving performance, how you are managing associated risk that might come with the work) and the numbers (the calculations). Some emerging de facto standards are informing a lot of rating/ranking systems and disclosure regulations (signs of unifying standards), but the emphasis of baseline comprehension – the narrative – from a buyer or investor standpoint is going to increase in parallel. 3rd party validation and certification for ESG reporting is an effective model to prove all boxes are checked for both the deeper context and the calculations.

In the voluntary carbon market, carbon offsets exchange is a great tool for financing carbon reduction projects; it will be a trillion-dollar market. We will see more standardized methods for verifying, monitoring, and certifications to improve accountability, but a global standardized carbon market is still far away and local initiatives will continue to take off.

The carbon accounting software market is too crowded; there will be consolidation events in the coming year. Commodity-like software alone isn’t enough as realities are too complicated. Most organizations like to have bespoke software as well as humans in charge of action planning/execution.

In terms of the cost of ESG certifications being a burden for suppliers, there are many free ESG project management tools and resources out there. Any companies working with facilities and materials should at least start tracking metrics and issues to build what’s needed to bid for customers; they will benefit from energy savings with all the data and insights built up even before the benefits of acquiring customers.

Slides used for this session

11.23.22-Wise-Ocean-Tech-Venture-Council-Webinar